We’re coming to you today with the Weekly Income Report. While we typically publish this recap of the prior week’s results on Mondays, John Hutchinson had a special update about the 3-Stock Strategy this week that took precedence.

In it, he gave away our three picks for November, which are doing so well that we’re going to continue holding them through December. If you missed John’s article, you can check it out here.

While we’ve closed out some profitable positions already this week, we’re only going to be discussing closed trades from last week. We’ll review our results from the holiday-shortened week on Monday.

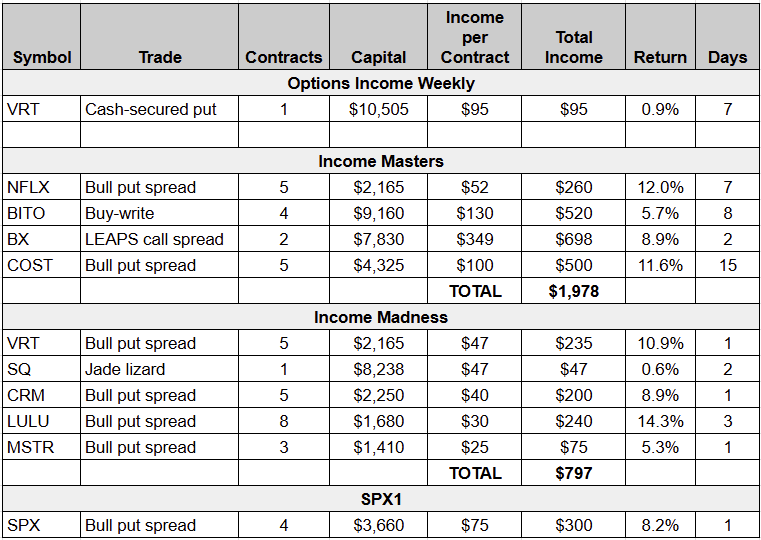

Here are all the closed trades from the week of Nov. 18-22, which saw $3,170 in profits booked across all of our services:

These results include trades from our November round of Income Madness, which featured four back-to-back days of live trading sessions that ran Monday to Thursday.

While Income Madness is now exclusive to the Income Masters program, we decided to break out the results to give you an idea of how it’s doing on its own (again, exluding the winners we’ve closed so far this week).

During our live trading sessions, we put on 15 trades (well, 17 if you include the two where we offerred two strategy options for members to choose from). By the time the market closed on Friday, we had booked profits on five of them, netting nearly $800 in the live account.

We utilized a variety of strategies, including cash-secured puts and bull put spreads, as well as a buy-write and a jade lizard. We also used a straddle in hopes of benefiting from a large post-earnings move in Nvidia (NVDA) in either direction. Yet, the notoriously volatile stock didn’t move nearly as much as expected. We finally got some movement in shares, which fell 4% on Monday. But we are going to need to manage the position.

But back to last week’s results.

After a rough go of it the preceding week with our SPX1 trade, we added another trade to the win column. We also held a special update session where we discussed our plans to make up the Nov. 15 loss as quickly as possible. This includes a laddered put spread approach that we will begin using next month.

We also closed out another profitable ProShares Bitcoin ETF (BITO) buy-write, this time in the Income Masters program. In the previous Weekly Income Report, we discussed a similar trade made at the Millionaire’s Trading Club event in Las Vegas.

The idea is to buy shares of the bitcoin ETF ahead of the ex-dividend date with an eye toward capturing the generous monthly payout while also selling a call option to collect additional premium.

We entered the latest BITO trade on Nov. 12, buying 400 shares and selling four BITO 29 Nov 25 Calls. By Nov. 20, with the price of bitcoin reaching new highs, it looked like we would be called out of our shares. We decided to close the position early with a solid profit of $130, or $520 on four contracts, and a 5.7% return in eight days.

We will look to re-open a position ahead of BITO’s Dec. 1 ex-dividend date to collect the $1 per-share payout.

Since we discussed BITO last week, the trade we want to take a closer look at today is the Blackstone (BX) LEAPS call spread from the Income Masters program.

This was actually our second profitable trade in a row since we reintroduced the strategy in the Income Masters program earlier in the month.

Dave Durham held a special training session for members on this strategy, which is sometimes referred to as a “poor man’s covered call.”

Rather than buying shares of a stock or ETF and selling a call against them, you purchase a long-dated call option (one year out or more), which are called Long-Term Equity Anticipation Securities (LEAPS). You then sell a shorter-dated call option to collect premium.

This is typically used as a stock replacement tactic, and it significantly reduces a trader’s capital/risk exposure. LEAPS call spreads can be set up with a neutral or bullish bias. The idea is to create a longer-term trade that generates income and leverages the power of options to reduce capital requirements.

As with all strategies, there are some disadvantages as well. Like a covered call or cash secured put, these are undefined risk trades. Traders also don’t collect dividends as they might be able to if they owned shares. And because of its DTE (days to expiration), LEAPS may experience lower volatile moves (in either direction) than shorter-term options.

Finally, you may need to be in the position longer if the underlying thesis changes. But that certainly wasn’t the case with Blackstone.

Blackstone is a global investment firm specializing in alternative investments. It operates across various asset classes, including private equity, real estate and private credit. It is known for its large-scale deals and its ability to generate significant returns for its investors.

We’ve been trading the stock for years in the Income Masters program. Most recently, we traded BX Perpetual Income style starting in late July, selling both calls and puts over the next few months and collecting a dividend along the way. We’d built up $638 in credit per contract when we exited the position on Nov. 1.

When we went back to BX in mid-November, we used a poor man’s covered call, greatly reducing our capital requirement. We entered the trade last week as a long-term position with a goal of opening and closing a series of covered calls around a December 2025 LEAP call option.

However, with the post-election run-up in the market, we were able to exit the trade one week later with a profit of $488 on two contracts.

The next week, we went back to BX following news the company was set to acquire a majority stake in sandwich chain Jersey Mike’s Subs for around $8 billion. Dave has known Mike’s Subs since it was a small shop in Point Pleasant, N.J., where owner Peter Cancro worked making sandwiches. In fact, he’s been purchasing their subs since 1982.

Dave saw this as another move by Blackstone to buy into a growth business without much debt and continue to benefit from the growth of this franchise business.

This time, with the stock trading at $182.51, we bought the BX 19 Dec (25) 155 Call and sold the BX 6 Dec 190 Call for a net debit of $39.30. We traded two contracts in the live account, meaning it cost us $7860 in total.

Again, the idea was for it to be an ongoing trade where we rolled the short call out every two weeks or so to generate income. But just two days later, the profits on the position were too good to pass up. As the stock continued to climb, we exited the position for a net credit of $42.64 each, booking a profit of $349 per spread, or $698 for two contracts, for a quick 8.9% return on risk.

When taking those two BX trades together, Income Masters members have netted $1,186. And if you add in the Perpetual Income profits, they are looking at $1,824 since late July.

We expect to trade Blackstone for the foreseeable future, taking advantage of its exceptional fundamental story while leveraging options to reduce our capital requirement. In fact, we just put on a new trade during Tuesday’s Income Masters live trading session.