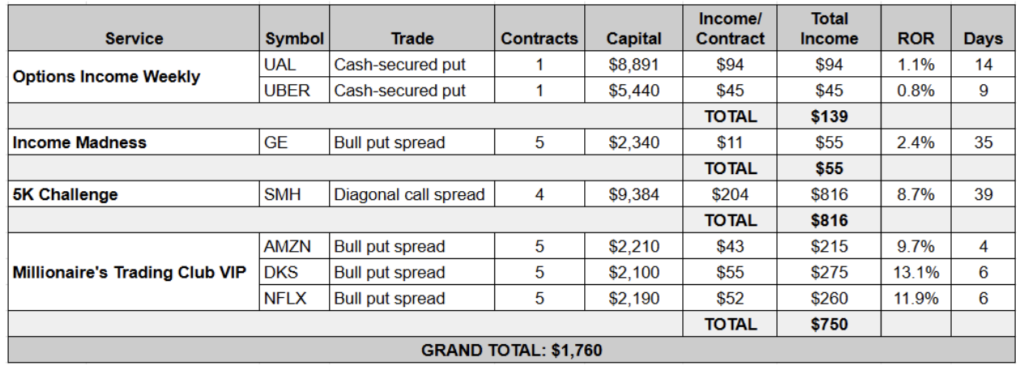

We closed seven winning trades last week across all our services, booking $1,760 in cash in the live account despite the holiday-shortened week.

Here are all the closed trades from the week of Dec. 23-27:

Last week’s closeouts included three trades from our Millionaire’s Trading Club VIP live trading event on Dec. 20. The goal of that session was to put on three to five trades to take advantage of a potential Santa Claus Rally heading into the end of 2024.

We ended up opening four bull put spreads and one call debit spread, each aimed at taking advantage of stocks we expected to trade higher into year-end.

These included four retailers — Amazon (AMZN), Dick’s Sporting Goods (DKS), Abercrombie & Fitch (ANF) and eBay (EBAY) – given the strength seen early on in the holiday shopping season.

Our target exit price for the AMZN spread was hit on Dec. 24, as the market delivered its best Christmas Eve performance since 1974. And despite stocks slipping on Dec. 26, reports of strong holidays sales boosted many retailers’ shares.

According to Mastercard, U.S. retail sales from Nov. 1 to Dec. 24 increased 3.8%, compared with a 3.1% rise last year. This was propelled by strength in online sales, which grew 6.7% year over year, with consumers spending more on apparel, jewelry and electronics. Given that I did 99% of my holiday shopping online, that wasn’t too surprising.

Mastercard also noted that Amazon and Walmart (WMT) saw record sales during Black Friday and Cyber Monday, while Target (TGT) and Best Buy (BBY) struggled.

The one MTC VIP trade that was not retail-focused was our Netflix (NFLX) bull put spread. However, this still fit with our holiday theme, and not only because the streaming provider offers a vast array of popular holiday movies.

In May, Netflix signed a three-season partnership with the NFL that included the broadcast of Christmas Day games. This deal could be very lucrative for the company.

On Dec. 26, Nielsen reported that a combined 65 million viewers watched the pair of games pitting the Kansas City Chiefs against the Pittsburgh Steelers and the Baltimore Ravens against the Houston Texans, making it a record-breaking day for Netflix. What’s more, 27 million viewers tuned in for the Beyoncé halftime performance during the Ravens-Texans matchup.

While NFLX closed lower on the day, not before our good ‘til canceled (GTC) order to exit the trade was triggered.

We pocketed a combined $750 in cash from these three holiday trades in less than one week. I don’t know about you, but that’s nicer than anything I got for Christmas!

But the trade we want to look at a bit closer today is another bull put spread: the GE Aerospace (GE) trade from Income Madness.

The first reason this trade stands out is that it was the final closeout from our November round of Income Madness. With GE, we closed 17 trades, all but one of which was a winner, and generated more than $2,800 in cash in the live account.

The other reason the GE trade stands out is that it could have easily ended up in the loss column.

We entered the trade on Nov. 21, the final day of our four back-to-back live trading sessions. GE Aerospace had delivered strong earnings reports throughout 2024, but a slight miss on its latest sales forecast was holding shares back.

With the stock trading just below $180, we sold the GE 20 Dec 167.50 Put and bought the GE 20 Dec 162.50 Put for a net credit of $0.62, or $62 per contract. We sold five contracts, generating $310 in cash.

But rather than bottom out, GE continued to fall, and our sold put went into the money. With the stock at $166.59 on Dec. 16, we rolled our spread out to the Jan. 3 expiration and lowered our strikes to 165/160 for a $0.30 debit. While this reduced our cash in hand by roughly half, it bought us some time for shares to recover and also reduced our risk on the trade.

As you can see on the chart below, GE bottomed out two days later before moving higher.

By Thursday, GE was back above the $172 level, and we were sitting on a small profit. Rather than risk holding on to the trade for another eight days to capture the remaining premium, we issued a closeout alert, booking $11 per spread, or $55 total on five contracts.

That’s not much, but it’s far better than taking a loss. What’s more, GE sold off on Friday along with the broader market, reinforcing that our decision to exit the trade early was the right one.

With GE, we closed the books on another successful round of Income Madness. To recap, we put on 17 trades over the course of four days of live trading. Of those, all but one was profitable and we pocketed $2,816 in cash in the live account in just over a month (38 days to be exact). We averaged a 7.1% return per trade with an average holding time of 10.4 days.

We have tentatively set the dates for our next round of Income Madness for Jan. 13-16. Income Madness is exclusive to Income Masters members. However, we are also running a special one-time Income Madness event for Investor’s Blueprint Live attendees in February.

This trading event will run Feb.19-25, featuring five days of live trading. The first three days will be held via webinar only, while the last two days will take place in person (or virtually) at Investor’s Blueprint Live in Boca Raton, Florida.

During these five days of live trading, we’ll be targeting short-term profits with an eye on exiting as many trades as we can in the days after the event. If you’re interested in joining us but have yet to secure your spot for Investor’s Blueprint Live 2025, you can do so here.

Just be aware that registration closes on Jan. 6. So, if you want to secure your seat, you’ll need to act soon. And if you do, you’ll get our Cyber Monday price.