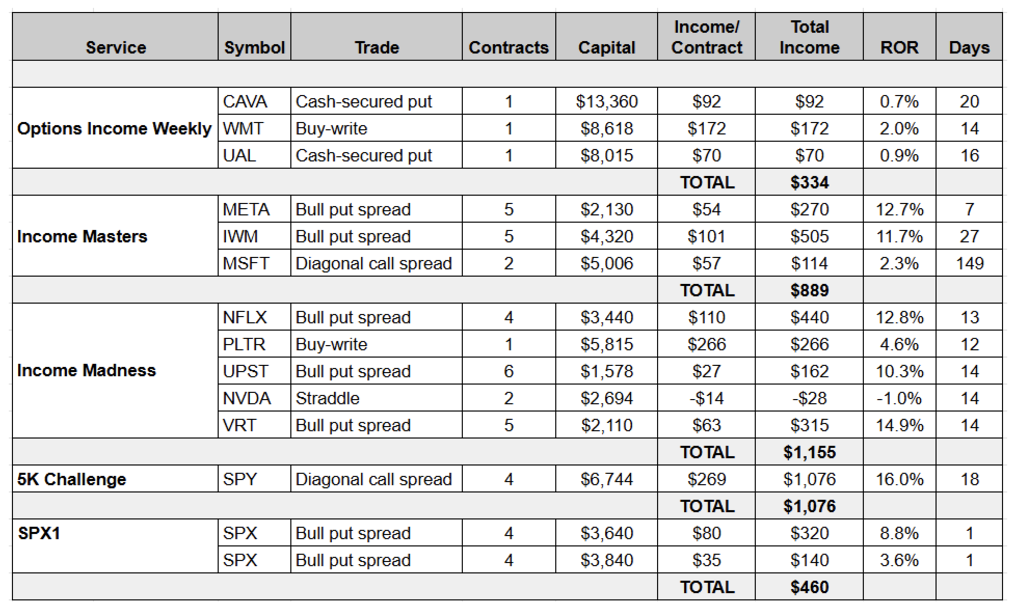

Last week was a busy one. We closed 14 trades and booked $3,914 in profits across all of our services. Here are all the closed trades from the week of Dec. 2-6:

This included another five Income Madness trades. We’ve now closed 14 of the 17 trades we put on during our four back-to-back days of live trading, pocketing nearly $2,600 in cash. We’ll report back with the final results once we exit the remaining positions.

This week, the trade we want to look at more closely might seem unremarkable. It wasn’t our biggest cash generator nor our highest return on risk. We didn’t uncover a new stock or employ a new options strategy. In fact, quite the opposite.

It’s the Meta Platforms (META) bull put spread from the Income Masters program.

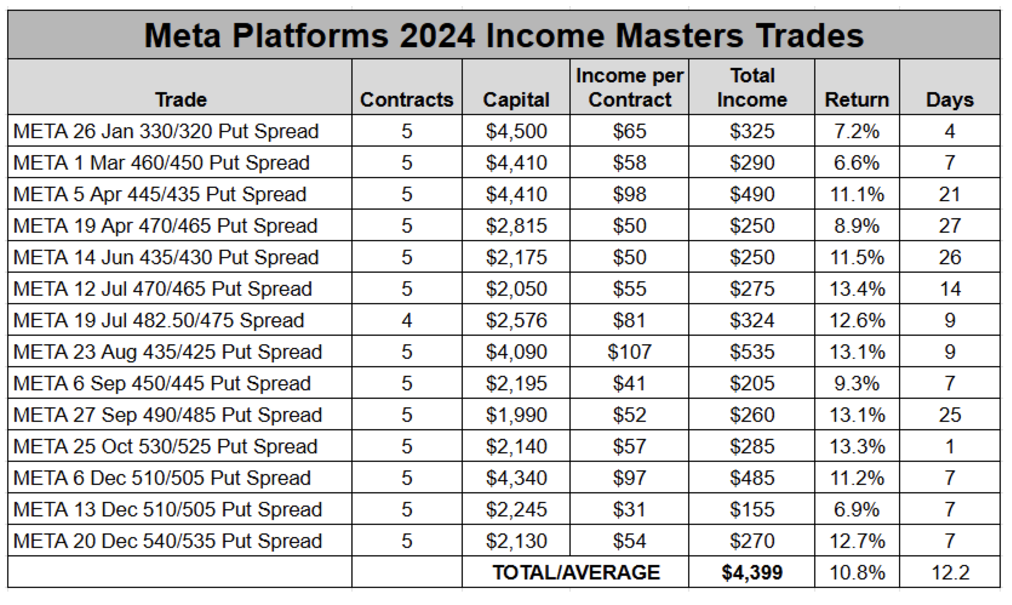

We’ve traded META dozens of times across our services over the years. So far in 2024, we’ve traded it 14 times in the Income Masters program alone. And due to META’s high share price (currently north of $600), the bull put spread is our go-to strategy, allowing us to significantly reduce our capital requirements while boosting our rates of return. (For more on the benefits of this strategy, see: “Bull Put Spread Strategy Shines Post-Election.”)

Here’s a look at how Income Masters members have done trading the stock so far this year.

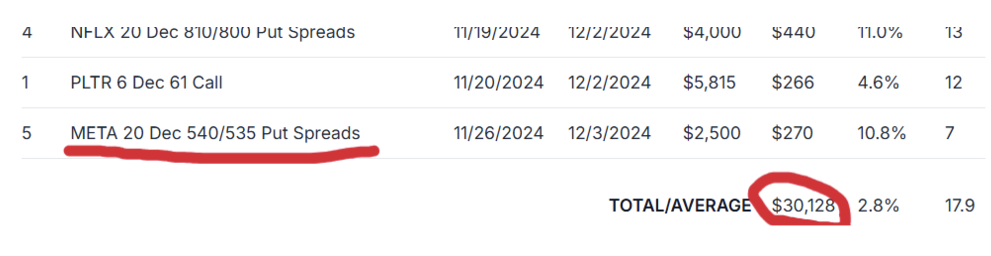

We’ve generated nearly $4,440 in income, averaging a 10.8% return per trade with an average holding time of just over 12 days. But as you can see in the table above, the latest META closeout was not a standout per se.

However, it was the one that took us over the $30,000 mark in year-to-date income generated in that service.

And that’s what makes last week’s META trade special. Because when selling options for income, it’s not about uncovering an unknown company or using complicated options strategies. It’s about generating consistent profits from stocks and strategies you are familiar with.

Factoring in the five Income Masters closeouts (which includes Income Madness) that followed META last week, we’ve closed 251 trades so far this year and generated $31,196 in income. Of those 251 closeouts, 234 have been winners and just 17 have been losers, giving us an impressive win rate of 93%.

This is due in large part to the strategic decision to manage positions when they go against us rather than accepting losses. The Advanced Auto Parts (AAP) recovery trade that we reviewed in the previous Weekly Income Report was a great example of this.

Of course, there are times when a trade is not worth saving. And we’ve taken our licks, including a couple of large losses in 2024. But given that our wins vastly outnumber them, we’ve been able to absorb them and come out well ahead.

We’ll be looking to add some more trades to the win column in the final few weeks of the year, including our remaining Income Madness trades. But, for now, we’re celebrating this achievement and hope that those who have been with us all year are too.

Before I sign off, I want to remind everyone that we are transitioning to the new email alert system this week in an effort to get alerts to your phones and laptops as fast as we possibly can. If you missed the webinar announcing this change, please watch it here.

We will strive for this transition to be as seamless as possible, but please bear with us as we roll it out and iron out any potential wrinkles.

On a personal note, I am on vacation this week. So, your next Weekly Income Report will be coming to you on Wednesday, Dec. 18.

Have a good week trading!