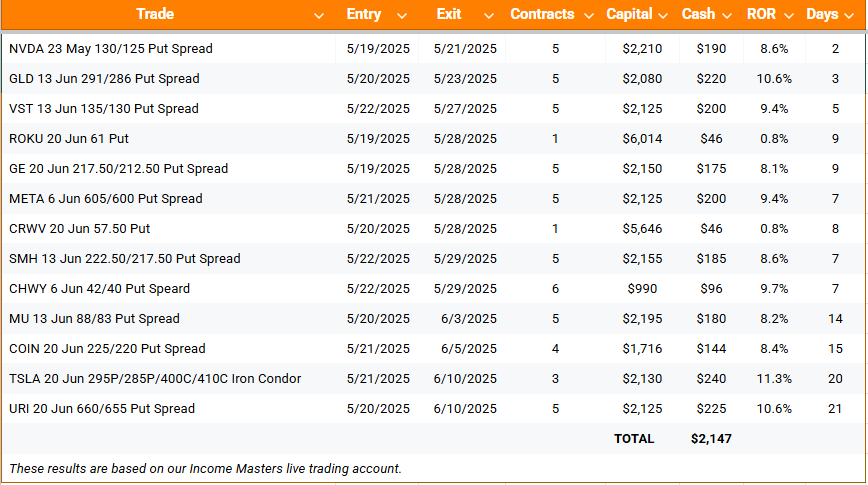

We exited 10 trades across our services last week, nine of which were winners that resulted in more than $2,500 in combined profits.

Here are all the closed trades from the week of June 9-13:

However, as you can see in the table above, we took one loss that wiped out a good deal of that cash: the Direxion Daily TSLA Bull 2X Shares (TSLL) long call trade from the Options Player Workshop.

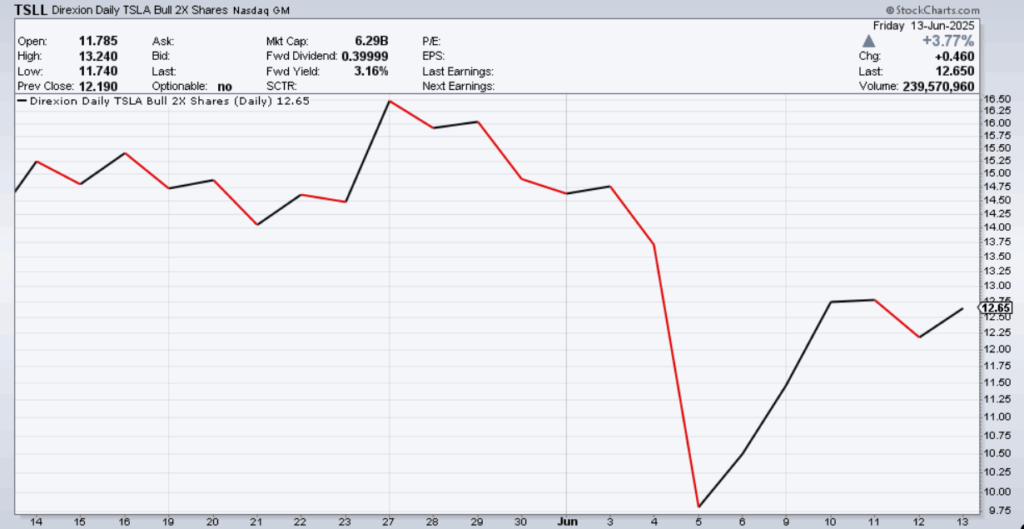

TSLL is a leveraged ETF that seeks to return 200% of the daily investment results of Tesla (TSLA). It achieves this objective by investing in TSLA securities and financial instruments like swap agreements and options that provide leveraged exposure to TSLA shares.

TSLL shares (and its options) trade for a fraction of the price of TSLA, making it a low-cost way to bet on a high-priced stock. Of course, Tesla is a volatile stock in and of itself. TSLL has all the risks of TSLA, plus the magnified risks of 2x daily leverage, compounding/volatility decay, and the complexities and costs associated with maintaining that leverage.

When you’re on the right side of the trade, that leverage can yield swift profits, especially when factoring in the additional leverage of long options. The opposite is also true.

Unfortunately for us, we entered our bullish bet on May 22. At the time, TSLA shares were trading around $340 and TSLL was around $15 a share.

A little over a week later, CEO Elon Musk and President Donald Trump got into a very public fight after Musk called the Trump-back tax and spending package a “disgusting abomination.” The escalating feud played out on social media platforms like X and Truth Social. (I’ll refer you back to last week’s discussion of the new options Greek, “Tweeta.”)

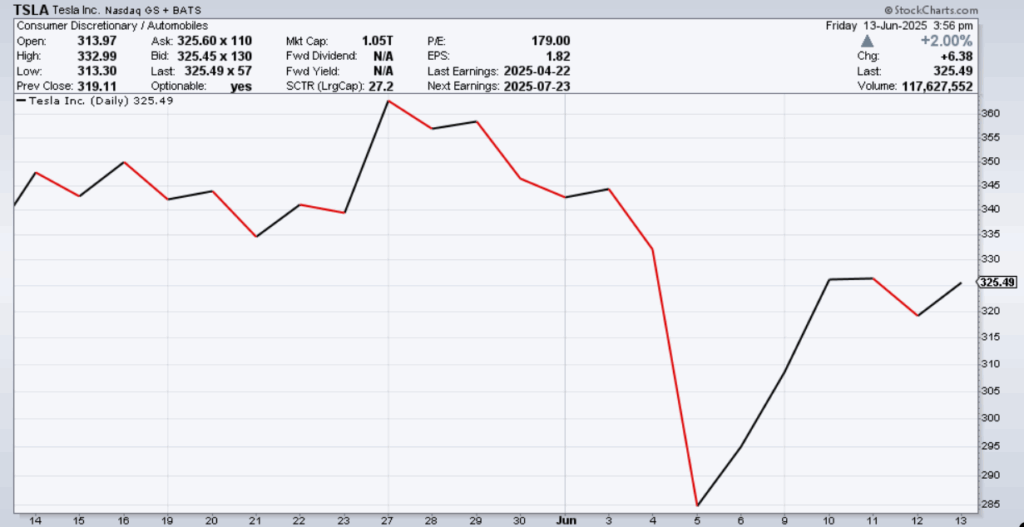

The headlines delivered a blow to TSLA, which saw roughly $150 billion in market value wiped out in a single day as shares fell 14%.

As you can see in the chart above, TSLA has recovered more than half of the ground lost following the spat. However, while TSLA lost 14%, as you might have guessed, TSLL plunged 28.5% on the same day.

With eight days to expiration, the June 20 TSLL call we purchased remained significantly below our 14.70 strike, so we decided to cut bait, booking a loss of $190 per contract and $1,900 on 10 contracts.

While that trade dented last week’s results, we were still net positive for the week. What’s more, the previous week’s Options Player Workshop closeouts more than offset that losing trade. So far, we’ve exited five of the six trades put on since the latest round started, netting $2,450 in profits in the live account.

We also closed out the final trade from the May round of Income Madness, which was a resounding success. In total, we exited 13 winning trades for a combined $2,147 in cash in just over three weeks, easily exceeding our goal of $1,500 in income generation.

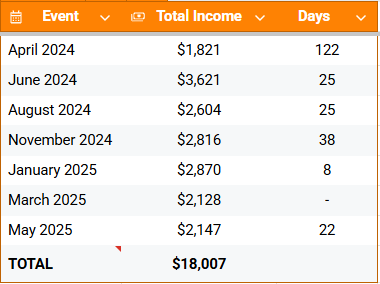

In fact, we’ve exceeded that $1,500 goal in each of the past seven rounds of Income Madness, going back just over one year.

We continue to manage one trade from our March round. But outside of that, we have booked more than $18,000 in profits from Income Madness trades in the past 15 months.

While we have not locked in on the exact dates, the next round of Income Madness will be held in July. With the second-quarter earnings season getting underway mid-month and a Federal Reserve meeting scheduled at the end of the month, there should be plenty of volatility for us to capitalize on.