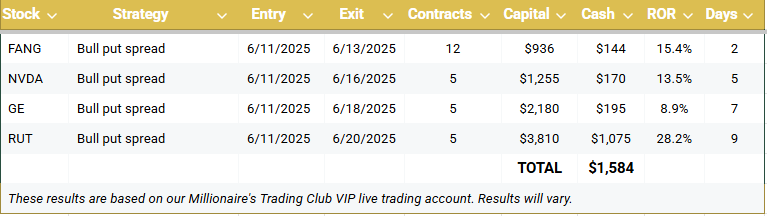

We exited five trades across our services during the holiday-shortened week, all of which were winners, booking more than $1,800 in profits.

Here are all the closed trades from the week of June 16-20:

With last week’s closeouts, we’ve exited four of the five trades from the Millionaire’s Trading Club VIP June session, netting nearly $1,600 in cash.

The clear standout last week was the Russell 2000 (RUT) trade, which generated $1,075 in profits on five contracts in just nine days. What makes this trade especially interesting was that it went against us, yet we were able to book an even larger profit than we initially targeted thanks to our active management of the position.

Let’s take a closer look.

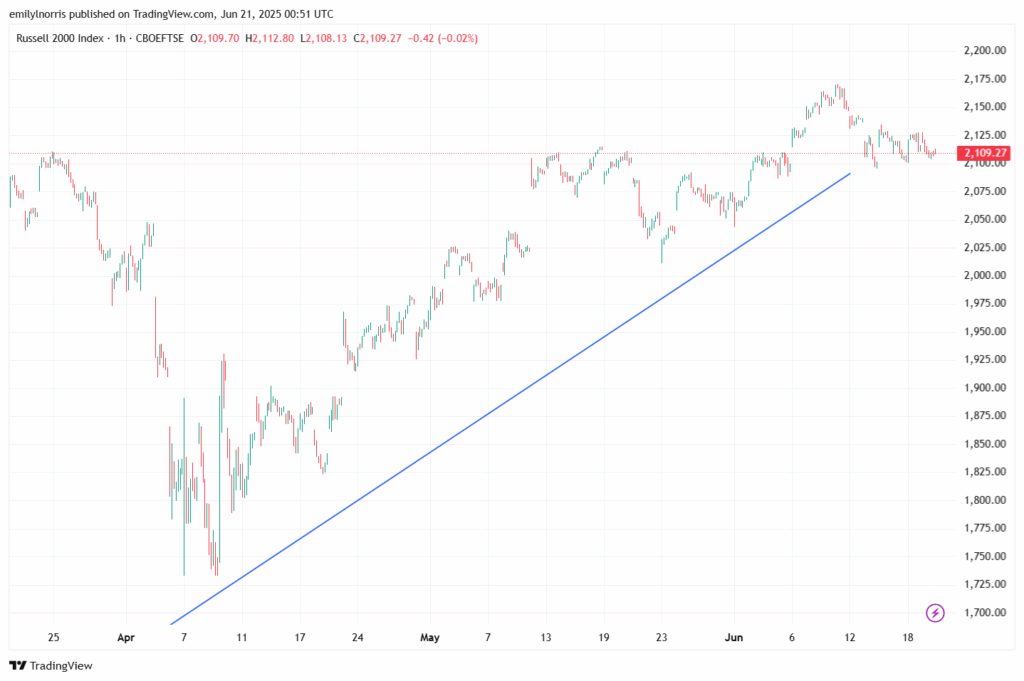

We entered the trade on June 11, when the Russell 2000 index was trading around 2,170. The goal was to take advantage of the slow-but-steady recovery in small-cap stocks off the April lows.

Specifically, we sold the RUT 16 Jun 2120 put and bought the RUT 16 Jun 2110 put for a net credit of $1.05, or $105 per contract. We traded five contracts in the live account, bringing in $525 in total credit.

At the time of entry, we set a target exit price at $0.50, or just over 50% of max profit, placing a good ‘til canceled (GTC) order at that level in hopes of exiting the trade ahead of the June 16 expiration.

But zooming in on the chart below, you can see we got into the trade near a short-term top in RUT.

Over the next five days RUT fell roughly 40 points to the 2,130 level. This brought us 10 points from our sold strike heading into expiration on June 16.

Indexes like the Russell 2000 have European-style options, which can only be exercised on the expiration date itself. This contrasts with American-style options, which can be exercised at any time between the purchase date and the expiration date.

This is one of the biggest benefits for sellers of European-style options, as you don’t have to worry about early assignment. This simplifies risk management for strategies like credit spreads.

However, RUT options are also cash-settled. This means that upon exercise or expiration (if in-the-money), there is no physical delivery of Russell 2000 Index components. Instead, the intrinsic value of the option (the difference between the settlement price and the strike) is credited or debited to your account in cash.

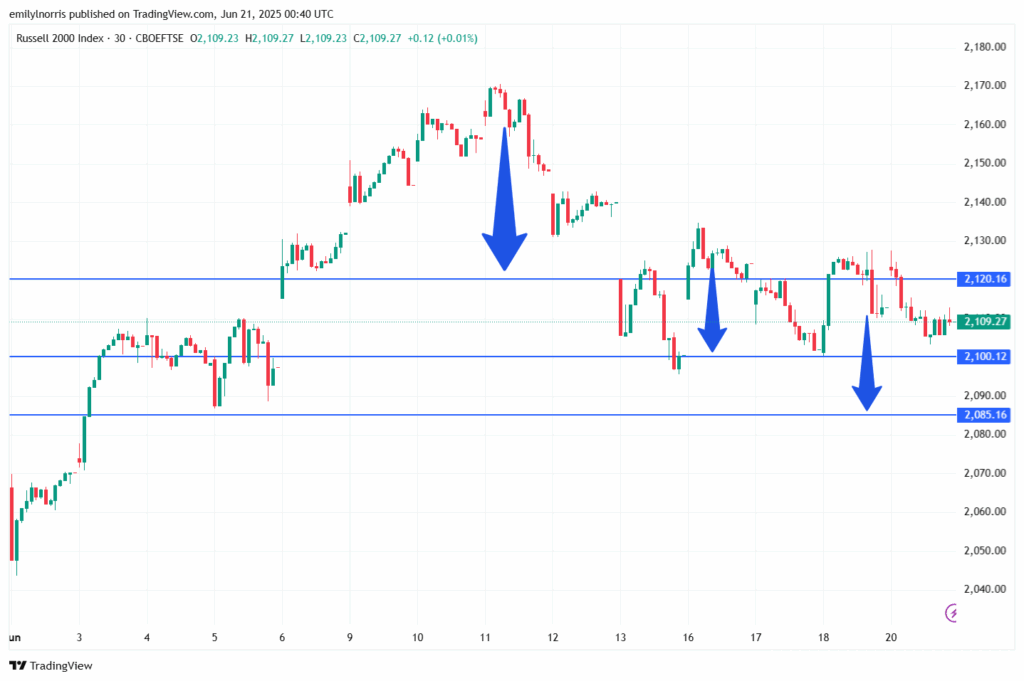

Rather than risk our trade going in the money and being cash-settled, we rolled out two days to June 18 and lowered our strikes by 10 points to the 2100/2090 puts. Doing so bought us time, gave us some breathing room and brought in an additional $0.63 in credit.

Yet, RUT continued to fall, and we again found ourselves in a situation where our short strike was just 10 points out of the money with expiration fast approaching. So, we rolled again, this time going out to June 20 and lowering our strikes by 15 points to 2085/2075. This adjustment netted us another $0.70 in premium, bringing our total credit to $288 per spread and $1,190 for five contracts.

This cash gave us a good deal of flexibility in managing the position. As the new expiration approached, we were able to close out the position for $0.23, earning $215 per spread and $1,075 on five contracts for a 28% return in nine days.

This far exceeded our initial trade goal and is a great example of how you can manage a position to profitability.

Our final position from the June Millionaire’s Trading Club VIP session – an Apple (AAPL) bull put spread — expires next week. We’ve had to roll it once already, similar to the way we managed the RUT trade. It’s possible we may have to roll it again if the market does not cooperate. But if AAPL moves higher or just stays flat, and we are able to exit the trade with even 50% of max profit, we’ll close the books on another very successful round of Millionaire’s Trading Club VIP with more than $1,800 in cash in our pockets from a single trading session.

Next month, we switch from monthly Millionaire’s Trading Club VIP sessions to our daily channel, where our focus will be on generating accelerated profits with rapid capital turnover using swing trade setups.

If you want to learn more about the Millionaire’s Trading Club VIP program, go here.