If you’re looking for a stock not named Nvidia, I have a couple of counter-intuitive plays for you today.

While inflation continues to take its toll on the less well-off, luxury goods have outperformed expectations. There’s a stock I’ve been watching for months – is it time to buy?

Plus, a company with a huge 5-year EPS Growth Rate that’s already “putting the work” on earnings success.

First up is our luxury goods company, Tapestry (TPR), whose core brands include Coach and Kate Spade New York.

Here’s the narrative: retail stocks have been beaten up (down?) this year as uncertainty looms over consumer spending.

But that spending issue has largely affected the lower end of the economic spectrum: middle and upper classes have not materially changed their spending. As well, both brands have global markets – you can always find them from outlet malls to airports.

And let’s face it (gentlemen)…handbags sell.

Why I like this stock: consistent long-term earnings growth in luxury apparel (11% 5-year EPS Growth Rate), reasonable price, solid price action (for swing-traders) and it pays a 3.17% dividend.

TPR also has a low short float less than 3%, so it’s not a play for the sellers and the price has a lower probability of manipulation.

The negative to TPR? The stock price has been range-bound between $30-$50 per share since 2021, but with global markets, brand appeal, a late cycle consumer, new products coming to market, I believe they’ll break out in the coming year.

Recent chart shows TPR coming off a long-term support line at $38, a flat 200-day moving average, and a strong move higher following its last earnings report.

EPS rising over the last three years, even though sales have flattened following the 2022 bear market. If sales get back to a rising trend, this company should outperform peers in the next 12 months.

TPR is currently trading for $43 per share, or 10% below long-term resistance of $48. Any momentum swing through that resistance should move the price up to $60, for a potential 25% gain in the next 6-12 months.

A Higher Risk Stock to Own

The second company is, admittedly, a higher risk play. But, if you can stomach some wild short-term swings, I think this one could pay off for you.

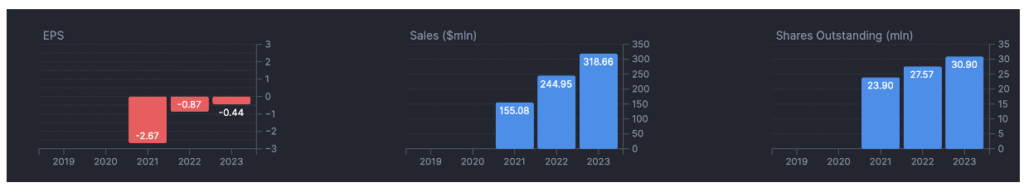

The company is Xponential Fitness (XPOF) and they represent a line of brand franchises in the fitness industry. It’s also a 3-year-old post-IPO, having launched in 2021.

I know the chart may not look all that sexy, but if one has risk capital, taking a small risk on a low-priced stock in a defined period of time can often pay off.

Now – upfront – this stock has a very high short float (meaning short shares outstanding) of nearly 20%. That’s good and bad. It’s bad because the shorts will drive the price down, especially if the company performs poorly in future quarters.

But it’s good if the company performs well – which is what is happening now as the company halved its loss in the most recent quarter and is expected to be profitable in the current earnings year (2024), swinging from a net loss to a net profit.

Recent earnings have been mixed: EPS missing estimates, but revenue beating estimates. If XPOF figures out how to turn earnings misses into earnings beats, this stock should rise from current $11 to $33 or higher, especially as sales are growing year over year.

I have price targets on XPOF of $22.90 (DEC 2024) and $33.20 (DEC 2025), which would represent a potential 100% to 200% return on investment in the next 12-18 months.

I’ll have more stock picks for you soon (unless you really, really hate them).