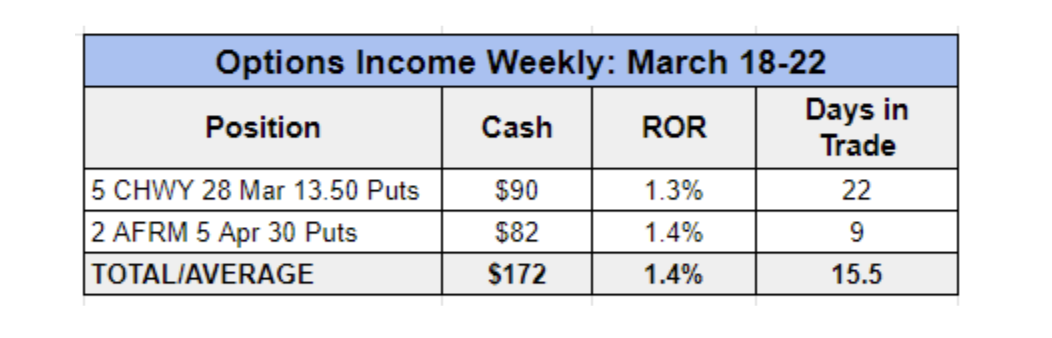

Options Income Weekly members closed out two more winners last week.

This included another successful trade on online pet retailer Chewy (CHWY). We closed the position a few hours before the company reported fiscal fourth-quarter adjusted earnings of $0.18 per share, blowing past the consensus estimate of $0.10 per share. However, the company’s Q1 revenue forecast disappointed, and shares sold off.

Even with the post-earnings sell-off, our sold put would have remained out of the money. But by closing the position early, we pocketed more than 50% of the max profit and removed the earnings risk from the equation.

This was our third winning CHWY trade over the past few months and an example of one of the consumer discretionary stocks with attractive implied volatility (IV) and options premium that we’ve been capitalizing on in Options Income Weekly.

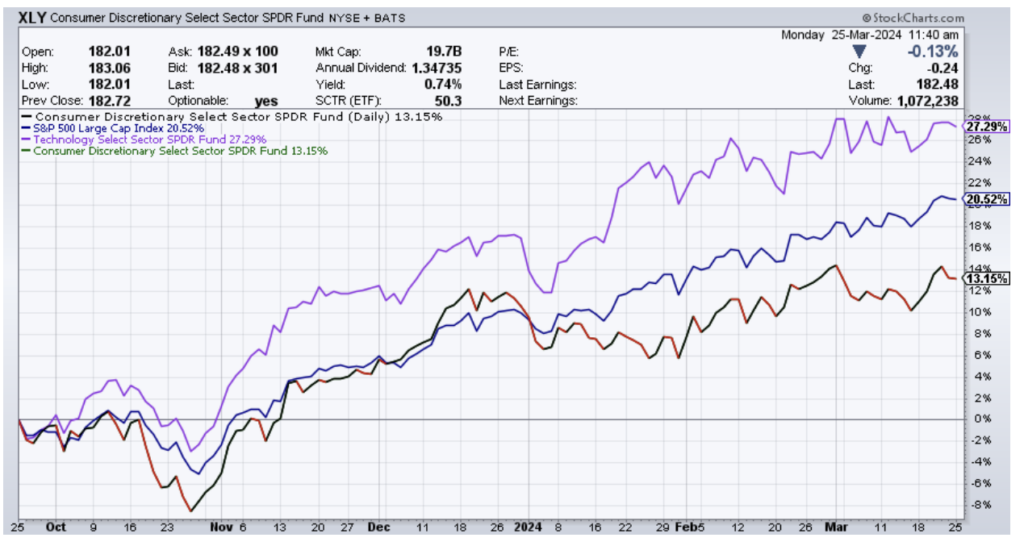

As a group, consumer discretionary stocks have returned 13% over the past six months. That’s less than half as much as tech stocks, which are up more than 27%, driven by investor interest in AI stocks and the performance of the Magnificent Seven. But consumer stocks’ return also pales in comparison to the broader market, which is up more than 20% during the same time.

Despite the sector’s underperformance, we have found great success trading a handful of high-IV consumer discretionary stocks for income in Options Income Weekly.

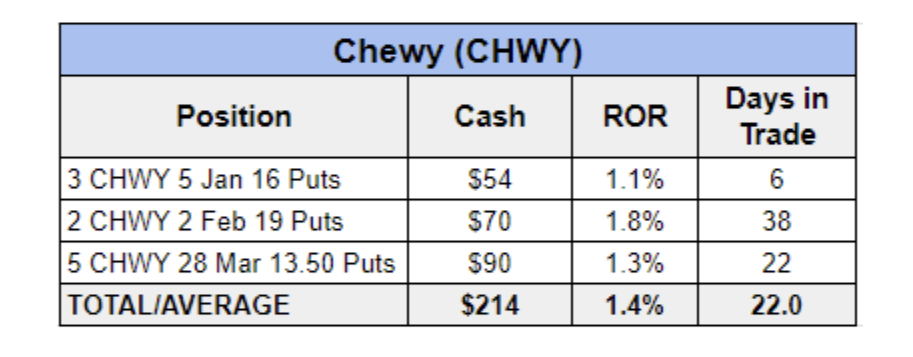

Chewy (CHWY)

Longtime Options Income Weekly members are very familiar with the online pet retailer. We’ve traded it dozens of times since early 2020, generating over $1,400 in cash. In the past six months, we’ve closed three winning trades, averaging a 1.4% return per trade.

The former pandemic darling topped out around $120 a share in February 2021. These days, CHWY is trading closer to $15 a share thanks to concerns about slowing growth, rising costs and macroeconomic headwinds.

Despite the 30%-plus year-to-date drop in shares, we’ve managed to trade the stock opportunistically, taking advantage of the low share price to sell multiple contracts and boost our income.

Chewy is a stock traders need to be careful with, especially around earnings. But there is cash to be made for those who are familiar with trading it.

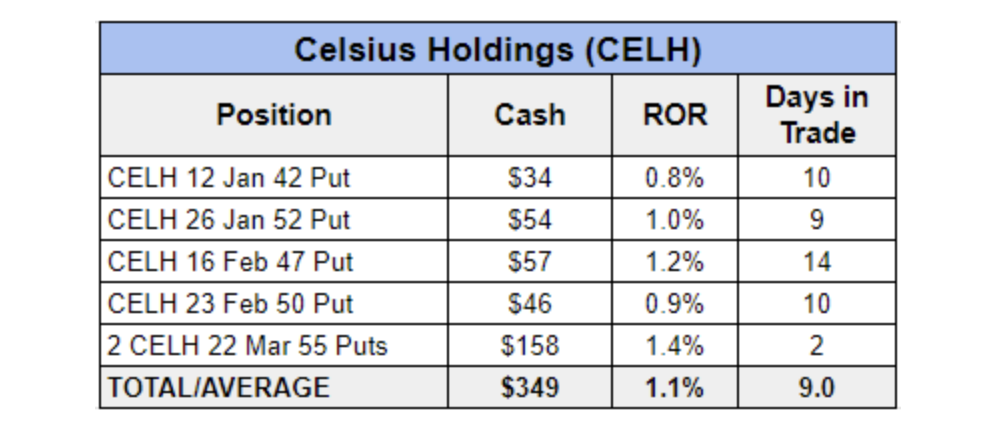

Celsius Holdings (CELH)

Celsius claims to offer a healthier alternative to traditional energy drinks. It is quickly gobbling up market share, ending 2023 as the No.3 energy drink in the United States. The company’s expansion efforts have been aided by a $550 million investment from PepsiCo (PEP). The long-term distribution agreement gives Pepsi an 8.5% stake in the company and should help support Celsius’ rapid growth efforts.

In late February, Celsius reported fourth-quarter earnings of $0.17 per share, compared with a $0.12 per-share loss in the year prior, but missing the consensus estimate by a penny. However, revenue surged 95% year over year to a record $347.4 million.

Investors cheered the report, even though revenue growth was lower than in recent quarters. And with the help of a likely short squeeze, shares surged 20% in a single day. Since the announcement, CELH is up 35% and has returned more than 60% in the past six months.

At Options Income Weekly, we’ve been capitalizing on the stock’s bullish momentum. In fact, CELH has emerged as our most traded stock of the year.

We’ve booked five winning trades in Options Income Weekly since we began trading it in September, averaging a 1.1% return per trade with an average holding time of nine days.

We’d like to continue trading the popular energy drink maker in the future. However, with the share price approaching the $100 level, we may wait to see a pullback in shares first.

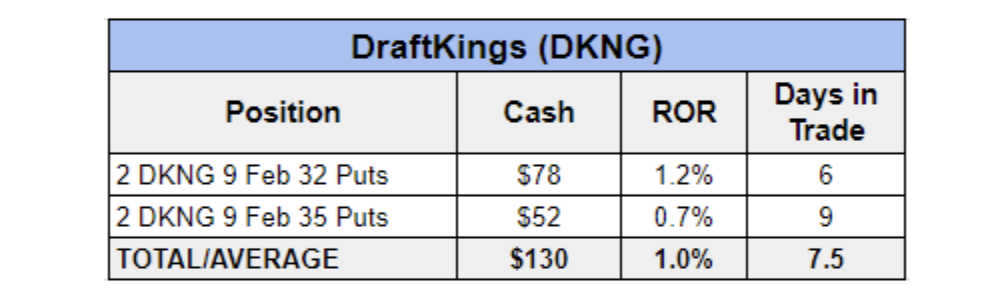

DraftKings (DKNG)

The digital sports entertainment and gambling company is a name we typically trade coinciding with major sporting seasons or events. In other words, this is predominately an opportunistic trade where we look to capitalize on increased investor interest and bullish momentum by selling options to capture premium.

For example, DKNG tends to perform well in the July-to-August timeframe in anticipation of the upcoming NFL season, which drives a lot of interest in sports betting companies. It also tends to do well in January, with the NFL playoffs in full swing and the Super Bowl on the horizon.

We traded DKNG twice in early 2024, exiting our latest trade just before Super Bowl weekend. Between the two trades, we collected $130 in cash and averaged a 1% return per trade in just over a week.

It’s likely we’ll go back to trading this speculative stock in a few months if DKNG follows its usual seasonal pattern.

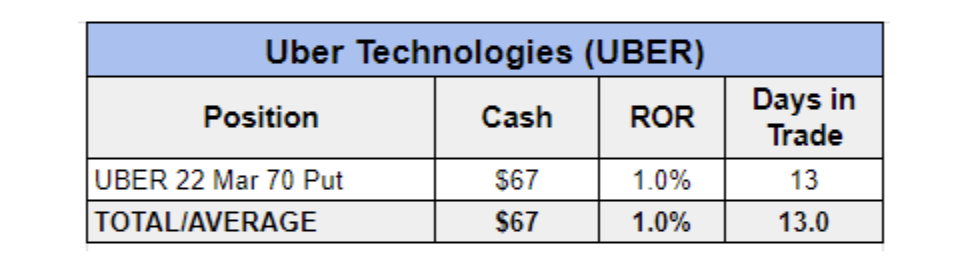

Uber Technologies (UBER)

We put on our first trade in the ridesharing company in late February on the heels of a strong earnings report. Earlier in the month, the company announced the first annual profit in its 15-year history, reporting an operating profit of $1.1 billion in 2023.

In addition to expanding its ridesharing offerings, Uber is growing its online food ordering and delivery platform, Uber Eats. While DoorDash (DASH) — which we’ve also traded in the past — dominates the online food delivery market with 67% of the market share, Uber Eats comes in second with 23%. As it continues to grow, Uber Eats should contribute more to the company’s overall profitability.

We’ve traded UBER once so far in Options Income Weekly.

With the company’s next earnings report not expected until early May, we could get another trade in before the announcement.

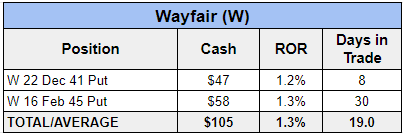

Wayfair (W)

This e-commerce company that specializes in selling furniture and home goods is another recent addition to the Options Income Weekly program. It offers a wide selection of home goods and convenient delivery options that have made it popular among shoppers.

This is another stock that has fallen a long way from its pandemic high of around $345 per share. It now trades around $65, making it a candidate for our cash-secured put strategy.

However, we should note that we were trading W back before the company’s latest earnings report. Since reporting a narrower-than-expected fourth-quarter loss and growth in active customers, shares are up 32% in just over a month.

Therefore, we may wait for a bit of a pullback in shares before selling another put. That said, it appears investors are on board with the company’s cost-cutting efforts. So, if shares continue to run higher, there’s no sense fighting the tape.

All five of the companies we mentioned today should be on income traders’ radars — whether they are looking for consistent income streams or opportunistic trades. If the Federal Reserve cuts interest rates in June, this could translate into increased consumer spending and consumer discretionary stocks could begin to play catchup with the broader market, presenting even more opportunities for option sellers in these names.