Hey everyone! I’m back for today’s Filthy Rich, Dirt Poor article. And today I’m going to write about a trade idea that I last did in February and walked away with a 5.42% return on risked capital in 6 calendar days, but it was only 3 trading days due to the weekend and the market holiday.

Let’s start with the fundamentals of a calendar options spread. This strategy involves buying and selling the same type of option for the same underlying security but with different expiration dates. For instance, one might purchase a two-month call option while simultaneously selling a one-month call option at the same strike price. This creates a debit position, with the goal of capitalizing on disparities in volatility and time decay while minimizing exposure to fluctuations in the underlying security.

Now, onto the Holiday Trade. This particular strategy is executed using the S&P 500 index (SPX). The premise involves selling a one-week option and buying a two-week option, typically close to the at-the-money strike price just before a market holiday.

For instance, let’s consider the following hypothetical trade setup based on the closing price of SPX as of March 26th, with the assumption of executing the trade on March 28th:

Sell to open the at-the-money put option expiring in 1 week: Sell 5 APR 5200 put.

Buy to open the at-the-money put option expiring in 2 weeks: Buy 15 APR 5200 put.

Debit: $13.70 per spread, or $1,370 per spread.

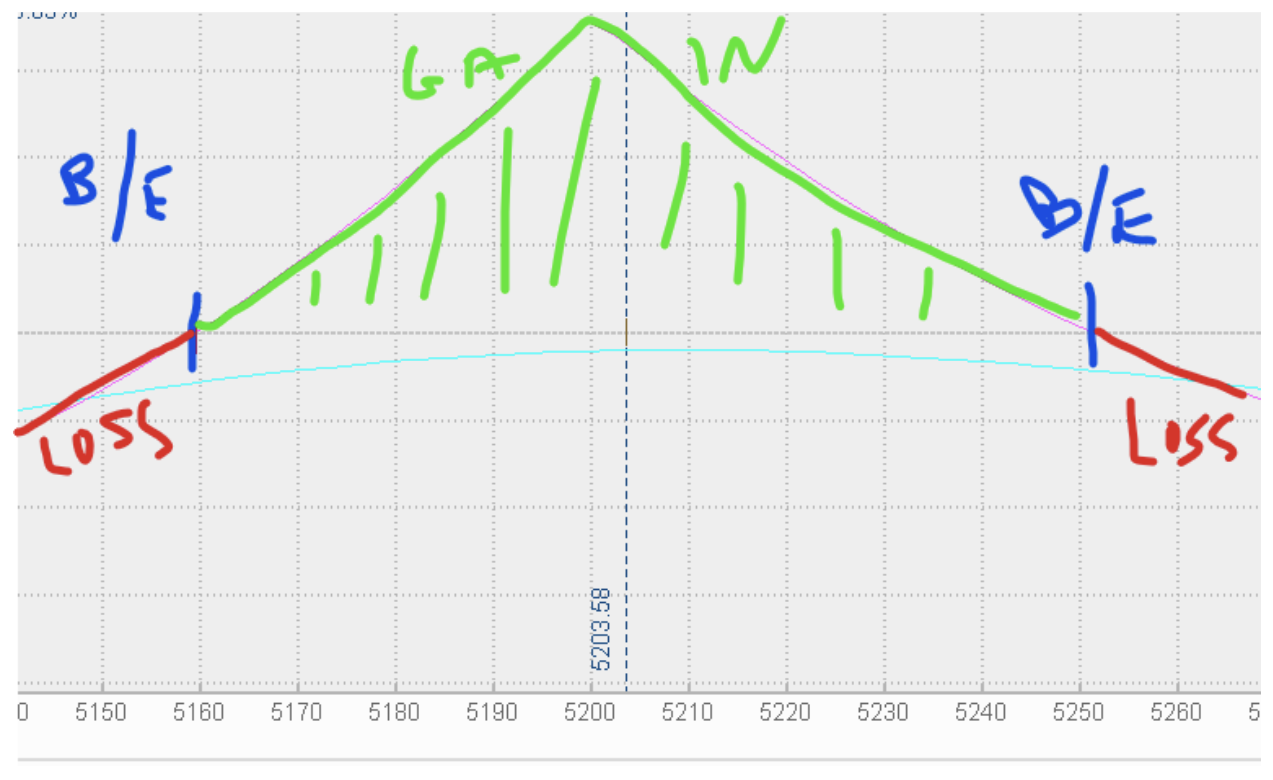

This strategy offers a risk profile with breakeven prices around $5160 and $5250. Profit can be realized within this range at expiration, while any movement beyond results in a loss. The maximum profit is achieved if SPX remains at $5200 at expiration. However, I don’t wait for expiration. I’m typically out a few days after the holiday for around 5-15% of risked capital.

What’s appealing about this strategy is its resilience to movement in the underlying asset, coupled with the potential to capture profits in just a few days post-holiday. If at any point the underlying goes through either breakeven points, get out of the trade and take a loss, unless you are comfortable with calendar trade repair strategies.

It’s important to note that an increase in implied volatility could enhance this strategy’s performance, given the higher sensitivity of longer-term options to volatility changes. Additionally, using put options tends to make this strategy more cost-effective, while keeping the same profit/risk profile.

That’s it. Keep it simple. Have a good holiday!