I wrote last week about how Income Masters members closed a short-term CES-inspired Nvidia (NVDA) trade. The buzz surrounding the consumer electronics tradeshow helped drive the stock to yet another record high and led to our sixth winning trade on the AI powerhouse since August.

Well, just before we closed out the week, we made that seven winners in a row. A positive earnings report from Taiwan Semiconductor Manufacturing Company (TSM) led to buying in chip stocks like NVDA, causing our latest bull put spread to hit its profit target.

Income Masters members pocketed $375 in cash on five contracts of the NVDA 16 Feb 490/480 put spread for a 7.5% return on the $5,000 in capital required ($1,000 per 10-wide spread) in just over a week.

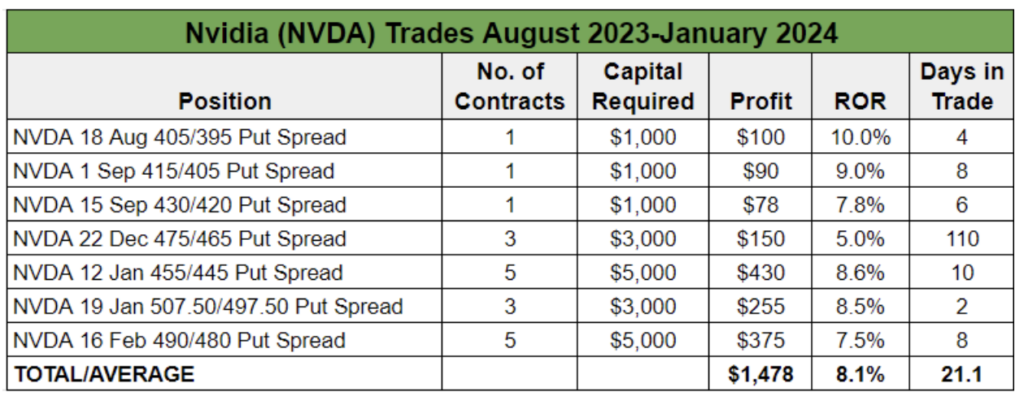

Here’s a look at all of our recent NVDA trades:

In total, we’ve generated nearly $1,500 trading Nvidia over the past few months, earning an average return of more than 8% on our capital in a relatively short amount of time.

With the stock up 235% over the past 12 months, concerns about potential overvaluation have emerged. However, with the company leading the way in artificial intelligence hardware and software, delivering strong growth and consistently beating analysts’ expectations, the stock could continue its run.

Analysts are certainly bullish on shares, with a number of recent upgrades. Of the 52 analysts who follow the stock, according to The Wall Street Journal, 48 rate it “buy” or “overweight.” The average price target of $672.31 is about 12% above the current share price, and some analysts believe the stock could make a move above $1,000 per share.

We’re not in the business of predicting stock price targets, but NVDA should see its bullish momentum continue if shares can decisively break above the $600 level.

However, as option sellers, we don’t need a big breakout in the stock to continue generating income.

For those who are not familiar with the strategy we’ve been using, a bull put spread, also known as a put credit spread, involves selling a put option and purchasing a put option at a lower strike price with the same expiration date to generate a net credit.

The maximum profit is the credit received and is achieved if the top leg finishes out of the money (OTM). While the profit is capped, so too is your risk, as the most you can lose on the trade is the width of the spread minus the credit received.

While bull put spreads have a directional bias, they also benefit from time decay. And given the volatile nature of Nvidia’s stock price, we typically sell a top leg that is well out of the money to account for the expected move in the underlying shares.

Nvidia is not scheduled to report earnings until Feb. 21, which means we could easily get another trade in and pocket more premium before this tech leader announces.