August 11th, 2023

Don’t Get Jackson Holed

Remember the last time the Fed gathered in Wyoming with other economic geniuses and blessed the markets with words of wisdom? If you don’t remember, I have a chart of it coming up for you, but here’s a hint… It’s enough to make you a believer in portfolio hedging!

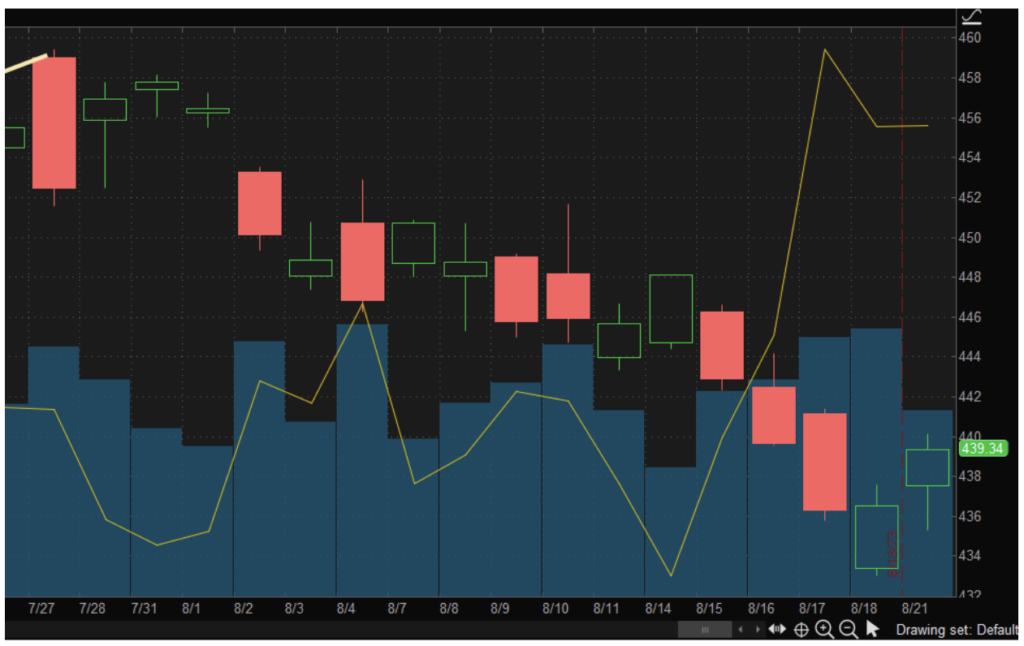

The day was August 26th, 2022, and the market was pulling back some from its nearly 19% run from the middle of June to the middle of August. Investors thought the worst of the bear market was over and we were on our way to beating previous swing highs. Until Jackson Hole.

In one day, the S&P 500 (SPX) had a high-to-low range of 145 points. The average range of the SPX is 45. That day the SPX closed lower by 3.3%! Worse yet, it shook markets to the core, and that started a wave of selling that didn’t end until October, for a total loss of nearly 17% in 34 days. That’s an average loss of 0.5% per day.

This week’s Jackson Hole economic symposium gives us the perfect reason to revisit another one of John Hutchinson’s previous posts.

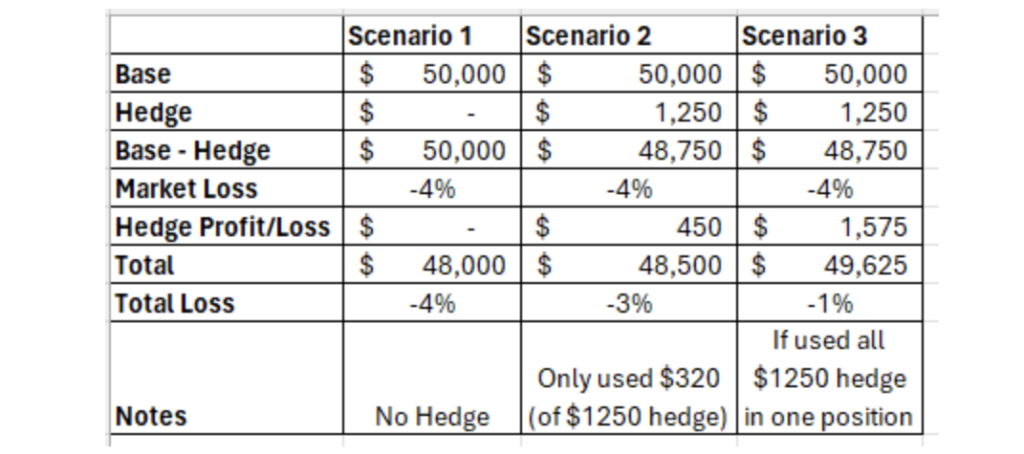

Back on July 28th, he wrote a method of buying puts at support levels. He assumed a $50k portfolio and was willing to allocate roughly 2.5%, or $1,250 to his hedging strategy.

At the time, he priced out the 18 AUG 440 put on the SPY for $1.60 per contract. He mentioned setting aside money to keep buying puts at various levels, so he started off with 2 contracts, for a total of $320, leaving more room in his $1,250 budget.

Assuming you closed out of that position one day prior to expiration, you could have walked away with over $450 in profit on your $320 investment.

John conservatively estimated collecting $320 in profits (little did he know what he was walking into), but he also addressed the dollar amount by saying,

“Now, let’s be honest, that’s not a huge gain in dollars.

But, when you’re hedging the stock market, you’re not going to go fully bearish with your entire portfolio – you’re looking to offset capital losses or valuation losses in the short-term until the market corrects itself and resumes moving higher.”

We hear from many people who say they don’t like hedging because they lose money. Well, yes, that’s true. That’s the purpose of the hedge. I don’t buy car insurance with the hope that I somehow make money. When I had a flood in my basement and lost everything, I was happy that I had paid for insurance as a hedge against a disaster.

If you did nothing, the market lost about 4% since July 27th. If your portfolio had a beta of 1, meaning it was perfectly aligned with the gains and losses of the S&P 500, your $50k portfolio by itself would be down $2,000. Let’s be honest, I know some of you have portfolios with a beta much higher than 1.0.

Let’s look at three scenarios:

If you didn’t do anything, your account likely lost 4% (or more).

If you wanted to step into your hedge and initially got into the one position John mentioned, you used about $320 of your $1,250 hedge allocation and after collecting the profits plus the hedge back, your account lost 3%.

The final scenario is if you used your entire hedge allocation into one position – the one John wrote about. That would have netted you about $1,575 in profits on your $1,250 investment. Adding it all back in and you would have only been down 1%.

If you think of it another way, even if you lost 100% of your hedge allocation (because the market took off higher), you’d still be in better shape than doing nothing and having the market drop 4%. The market rises and you lose $1,250 (assuming you don’t exit your hedge). Sure, that’s not fun. But without the hedge, the market just had to drop 4% and you would have been down $2,000.

So, is hedging worth it? That’s a personal answer. Some people are good at reading price action on a chart and exiting their entire portfolio, but most of us do better over time by adding some type of hedge.

When should you hedge? That brings us back to Jackson Hole. Will the market suffer another 3% drop this year? I don’t know, but the question you need to ask is how your portfolio will react if the market does drop again. A $1,250 investment for a $50k portfolio is fairly cheap if it saves you $1,625 of losses (the difference between the total of scenarios 1 and 3).

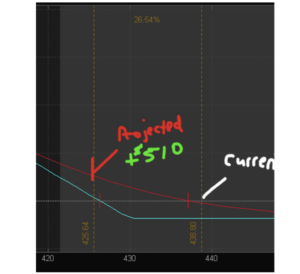

At the time of this writing, the SPY is trading around $438 and the 15 SEP $430 put is going for $3.70.

If the SPY drops another 3% by the end of the week and is trading around $425, the put would give you around $510 in profits.

if you want to read John’s original post, head here.