With the market pulling back, we thought it would be a good time to talk about the Inverted Put Ladder hedge, which we previously detailed in July to a better than 200% profit.

Jeff Wood and I rebuilt a new Inverted Put Ladder for September-October, as we see weakness in the major indices causing another short-term pullback.

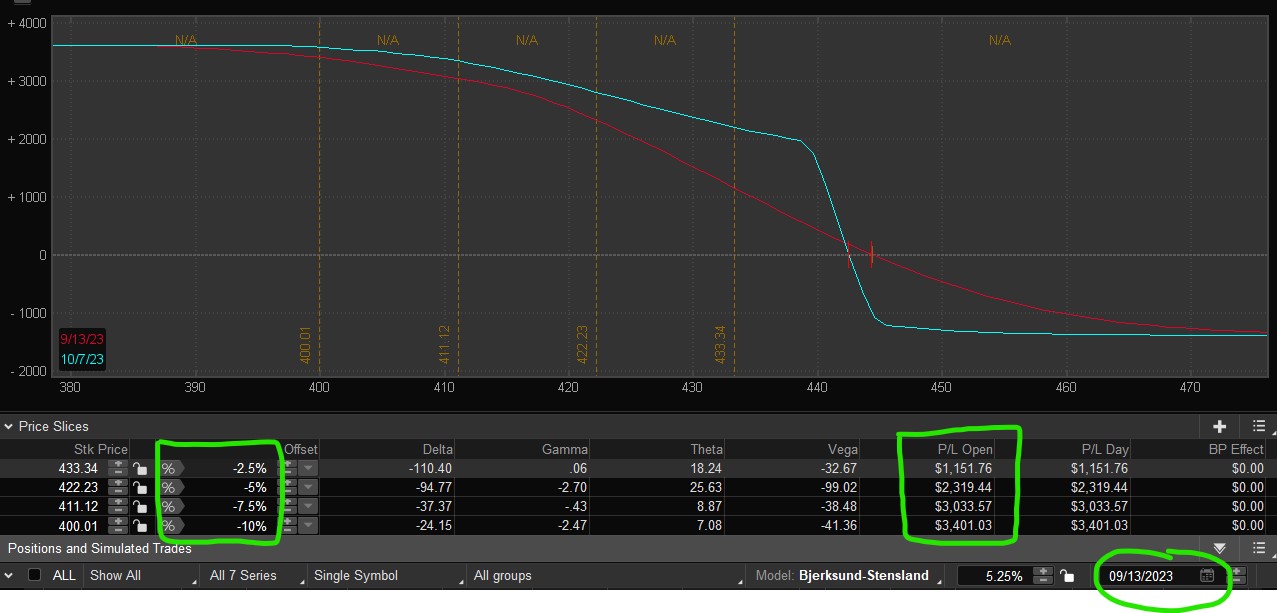

In this post, we’re detailing the impact of a correction ranging from -2.5% to -10% and the 4 rungs of the Inverted Put Ladder you could use to hedge against a correction.

A reminder that this trade idea is for education purposes, however, we’ll keep track of it as if we’re trading it.

Hedging is designed to offset short-term losses in value or positions; hedging should be approached the same way you approach a 7-11 convenience store: get in and get out.

To hedge our portfolio we use 2.5% of the value of the portfolio for hedging purposes. Preferably on a single position, but larger portfolios can increase hedging to up to 10% of total portfolio (several positions).

For our purposes today, we’ll assume a $50,000 portfolio, using 2.5% of capital, or $1250 per hedge trade.

For the Inverted Put Ladder, our objective is to capture profits as the market moves lower. For our trade today, we’ll use the SPDR S&P 500 Trust ETF (SPY).

Let’s review the SPY and potential correction levels:

Next, here are potential target levels in the SPY based on correction values:

Price Correction Value

| SPY | Correction | Target |

| 449 | -2.5% | 438 |

| 449 | -5.0% | 427 |

| 449 | -7.5% | 415 |

| 449 | -10.0% | 404 |

Building the Inverted Put Ladder:

Because most corrections are quick in nature, we’re going to go out roughly 30 days for the top two rungs and another 15 days from there for the lower two rungs.

Rung One: BUY +3 SPY 100 (Weeklys) 6 OCT 23 +445/-440 PUT @1.80

Rung Two: BUY +3 SPY 100 (Weeklys) 6 OCT 23 +444/-439 PUT @1.68

Rung Three: BUY +2 SPY 100 20 OCT 23 +435/-430 PUT @.99

Rung Four: BUY +2 SPY 100 20 OCT 23 +425/-420 PUT @.58

Notice that not all rungs have equal contracts. We did that because we’re trying to spend around $1250 (debit) Since rungs Three and Four are far out-of-the-money (and less likely to have a large payday unless the market sells off hard), we wanted to put more money toward the top rungs.

This should cost about $1358.

Below are the potential profits on your hedged ladder would look like one week from today should the market fall either -2.5%, -5%, -7.5%, or -10%.

Profit potential ranges from $1,161 to $3,400 (not realistic) if the market declines to our target levels in just one week.

Remember that in July, our max gain occurred closest to expiration for the top two rungs, so while time decay does work against us, if the SPY moves in our favor we should still see a valuable trade.

Debit spreads decay with time so it is important that the market moves in the direction of the debit spread for the value of the spread to become profitable.

That means you do need to monitor these trades and be ready to exit if the market does reverse (move higher).

Which is exactly what we’ll do in the days and weeks ahead on this version of the Inverted Put Ladder.

We’ll have more ideas for you tomorrow!