To hear the media experts tell it, Wednesday’s Fed meeting and the sell-off in stocks was because the Fed may hike rates another quarter point in 2023. Once again, the media has it all wrong…

The Fed has signaled throughout the summer that rate hikes in 2023 were nearly done by changing their forward-looking statement from May through September.

So, another rate hike has been a possibility since the summer meeting cycle.

What changed – and the reason stocks sold off, and will likely continue to sell off – is the Fed dashing the market’s hopes of multiple rate cuts in 2024.

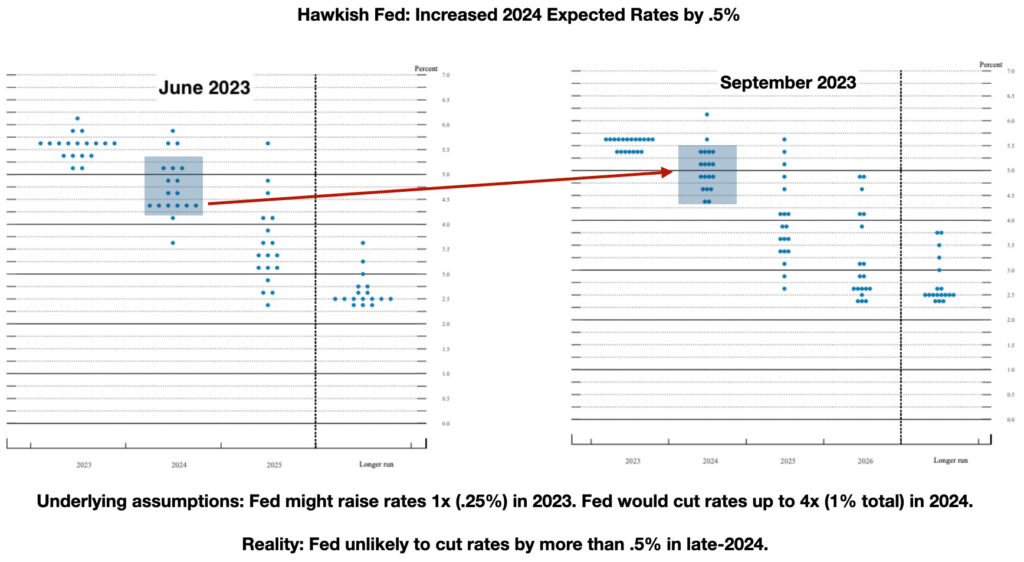

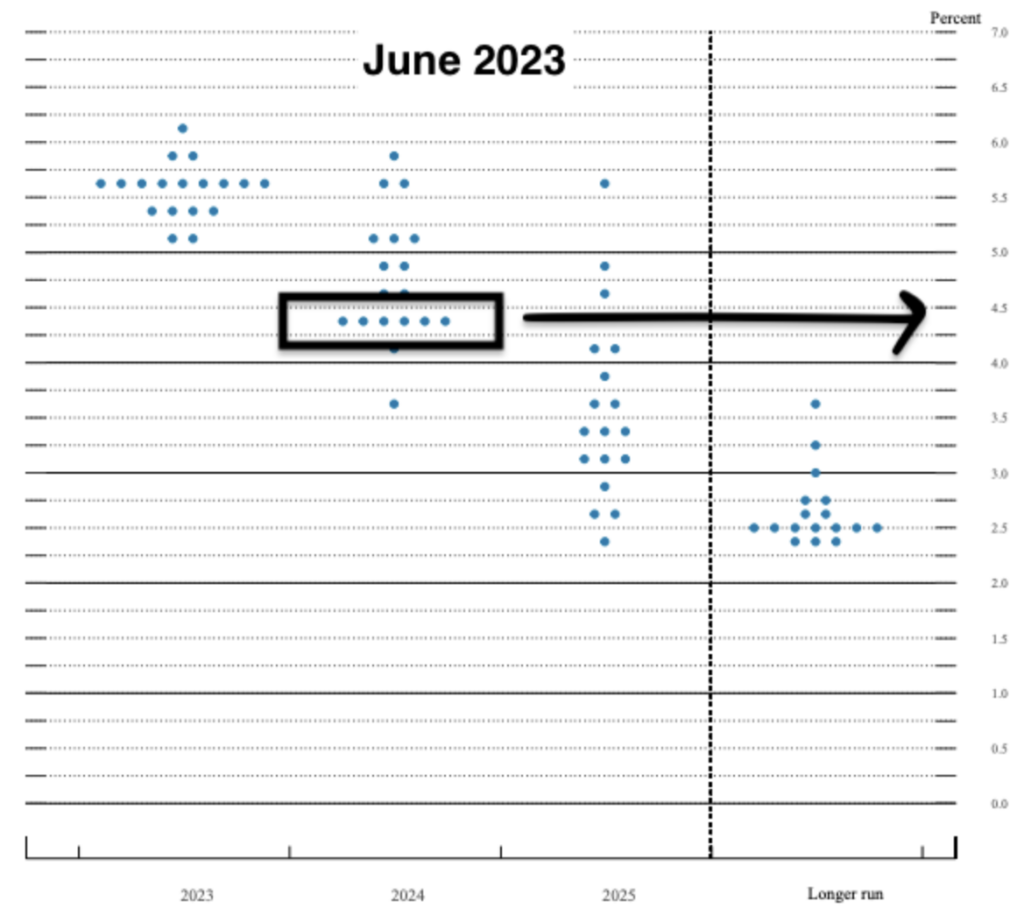

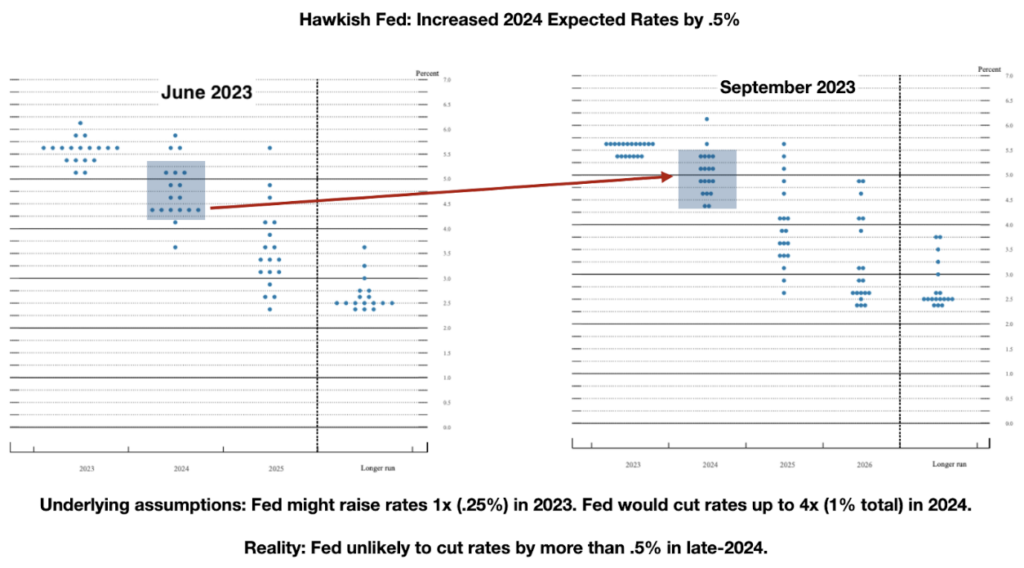

To see this visually, we’ll use the Fed’s “Dot Plot,” which shows to what level Fed governors (voting and non-voting) expect interest rates into the future.

In June, you can see a solid voting line between the 4.25% and 4.5% level

From current interest rate levels, this suggested potential rate cuts in 2024. Wall Street had priced in nearly 1% in cuts, across 4 rate cuts by the end of next year.

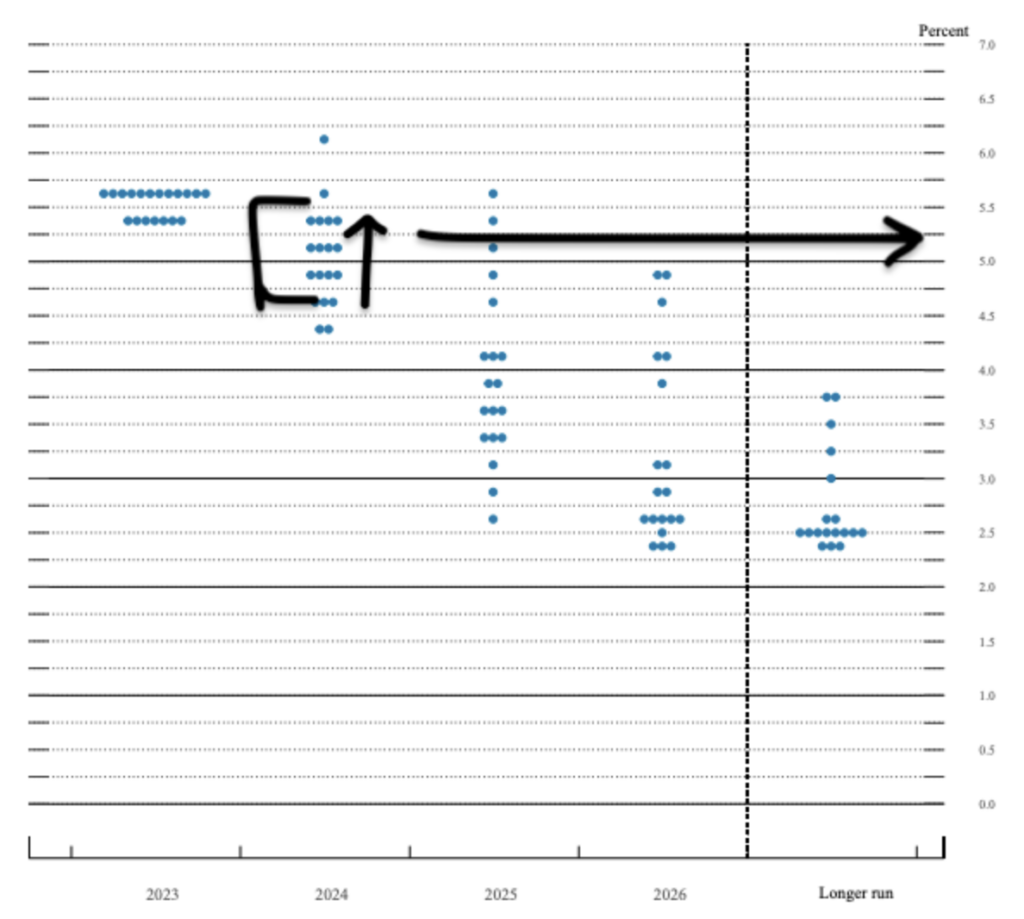

Which is now unlikely to happen when we look at the September votes:

First, the end of 2024 interest rate block is now above 5%, a swing higher of .5% (one-half percent). That was a significant voting swing higher, to an average rate of 5.125% (from 4.625%).

Which means from current levels, any rate cut isn’t likely to happen until Q3-Q4, 2024, and even if such rate cuts occur, at best, we’d see the Fed reduce rates by a total of .5% from 2023 levels.

Why This Matters:

Higher rates for longer put more pressure on corporate earnings; increase the value of longer-dated treasuries; and, risk a major policy error by slowing the economy too much, too fast.

You’ve probably heard the phrase soft-landing all summer, as that remains the Fed’s goal as it fights still elevated inflation. But, higher interest rates negatively affect consumer spending for large purchases: homes, cars, boats, appliances; and decreases spending in consumer discretionary categories because these purchases are usually made with credit cards.

With recent reports about rising delinquency rates in credit markets, this is where the policy mistake comes into play by weakening consumer’s ability to spend money.

Put these puzzle pieces together and the current valuation of the S&P 500 is not supported by 5%+ interest rates against the backdrop of still-high inflation, a weakening consumer, and safer alternative investments in treasuries.

I see increased risk of a correction into the fourth quarter – earning in October could help prevent this or could make it worse – but from a valuation perspective alone, it’s difficult to see the path higher from here YET (keyword, yet).

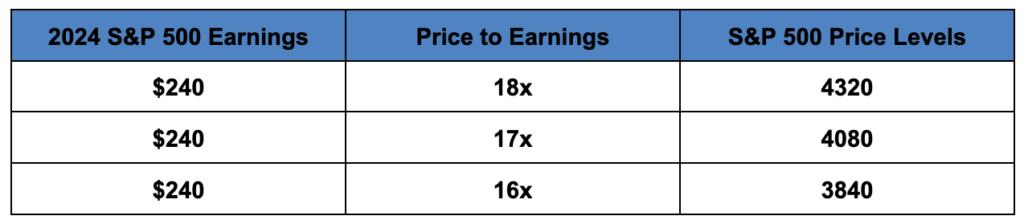

Current earnings expectations for the S&P 500, full year in 2024, are $240. With higher rates for longer, anything above an 18x multiple is not supported by long-term history.

That’s also assuming that the economy does not do worse than expected and 7-8% growth in earnings happens in 2024. That seems less likely to me since we have yet to see the real impact of 5% interest rates over several quarters.

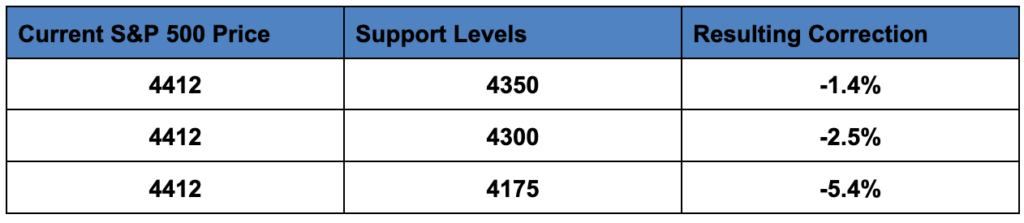

Right now, that 4320 is the line at risk, although we should see support between 4350-4380 before that happens. Any violation of the August low (4350) and the S&P 500 should challenge

Looking out wider, short-term support below 4350 rests just below 4300. Longer-term support (one-year line) is at 4175 to 4150.

You can see that these are supported by the 17-18x multiples from the prior table (4380-4080).

Short of a significant recessionary event, which is not predicted, this seems reasonable for a market which needs to reprice stocks forward.

How to Protect Yourself:

First and foremost, if you’re trading, keep your positions shorter and be willing to close trades sooner even if it means sacrificing returns.

If you’re investing, have capital on the sideline so that you can add shares or buy stocks at ‘lower’ prices

Hedge your portfolio or positions using inverse ETFs (as we’ve shown you in these stories here, here and here), or by leveraging options to protect against down moves.

We’ll have more analysis and what you can do in the coming days and weeks ahead.