Today is the day the market has been waiting for. The rally from all-time highs stalled as the market awaits the Nvidia (NVDA) earnings report. The macroeconomic calendar is fairly light this week, so it all comes down to this moment. Will the bears wake from hibernation or will the bulls stomp higher to new ground? How did the market respond the last time Nvidia announced?

The volatility index (VIX) is nearing its 1-year low, showing investors are bullish heading into the big day. About 81% of the reporting S&P 500 companies have beaten Q1 earnings estimates, but the reaction in stocks has been related to future guidance more than earnings themselves. It’s key to pay attention to what their officers say about future guidance even if Nvidia has blowout numbers.

We won’t know how investors react, but this time feels different than three months ago when Nvidia last reported. At the time, the S&P 500 had fallen nearly 2% heading into the big day and everyone wondered if a major pullback would happen.

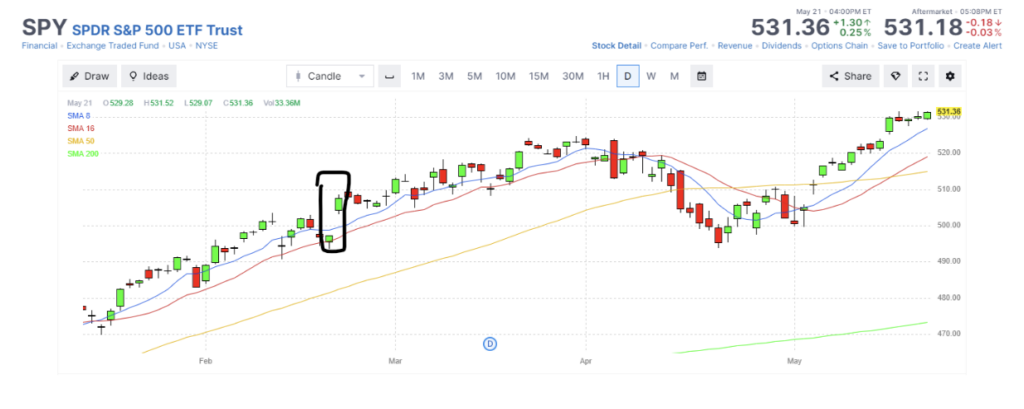

But Nvidia changed all that by crushing earnings (see black box below), and single-handedly pulled the market up from its 16-day moving average and allowed it to resume course until April when the pullback finally happened.

But look to the right of the chart now. The market isn’t in the same situation as before. The market breadth is stronger, with more companies still recovering from April. We’re no longer as concerned with a major pullback since we just experienced one. The market will react to poor earnings, of course, but it’s in better shape to be able to recover from it, should Nvidia fail to impress.

What will also weigh on investors’ minds is the market is now suggesting the probability of the Fed announcing a -25bp rate cut to just 25% at the July FOMC meeting. Those waiting on interest rates lowering may have to wait a bit longer before a major purchase, because interest rates will undoubtedly stay higher, for longer, as the Fed has been saying all along.

Big-box retailer Target (TGT) will have already released earnings by the time this article comes out, and give us an indication of consumer spending habits and if consumers are feeling the pinch of higher interest rates.

While the year started strong for the company, the stock price has yet to recover from the April pullback and any signs of weakness during the earnings call may push this stock lower.

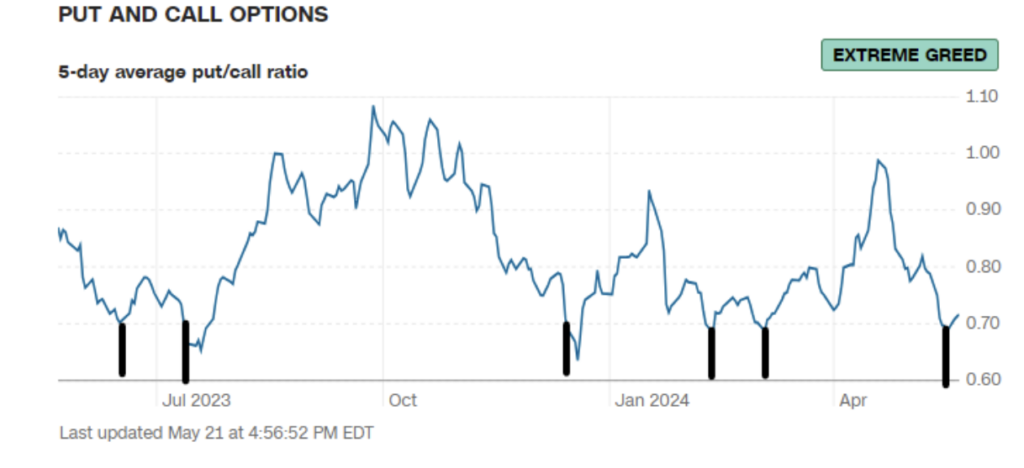

What I also find interesting is the 5-day average of the put/call ratio, showing investors are extremely greedy right now, writing more calls than puts.

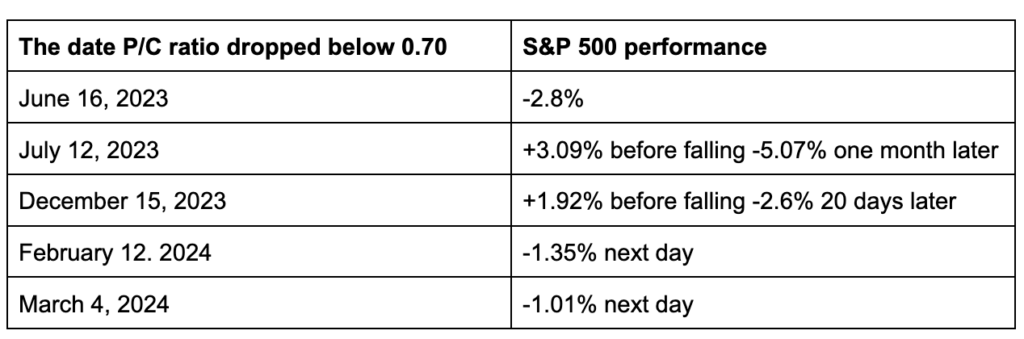

The last few times the ratio got below 0.70 meant a big drop in the market was coming. Will that hold this time?

Maybe Nvidia will boost the market higher. As I wrote in the previous article, maybe a strong 5%+ gain in the S&P 500 for the month means the market will continue to creep higher.

The put-to-call ratio under 0.70 as it is now doesn’t mean the market will necessarily fall the next day (although that’s what happened the last two times), but it does mean investors are full of greed and complacency and that can be a recipe for disaster.

If Nvidia doesn’t bring the market higher, here are the key support levels I’m looking at in the S&P 500 (ticker: SPY). As long as we can hold above 508, I expect the markets to continue higher, but realistically I’d expect us to bounce off the 50-day moving average long before we can get down to the 508 level.

Whatever the market brings, there will be a trade and a strategy to deploy, but first, we need to get past the rapid reaction (or overreaction) to whatever Nvidia and FOMC meeting minutes will bring. Let the roller coaster continue and enjoy the ride until we get a clearer picture of where the market is heading.