A key bond market signal of an upcoming recession has flashed red continuously for the longest time ever. The part of the Treasury yield curve that plots two-year and 10-year yields has been continuously inverted – meaning that short-term bonds yield more than longer ones – since early July 2022. That exceeds a record 624-day inversion in 1978.

Markets have historically dropped greater after longer periods of inversion, but this market has proven over and over that it’s not ready for a recession. Until now!

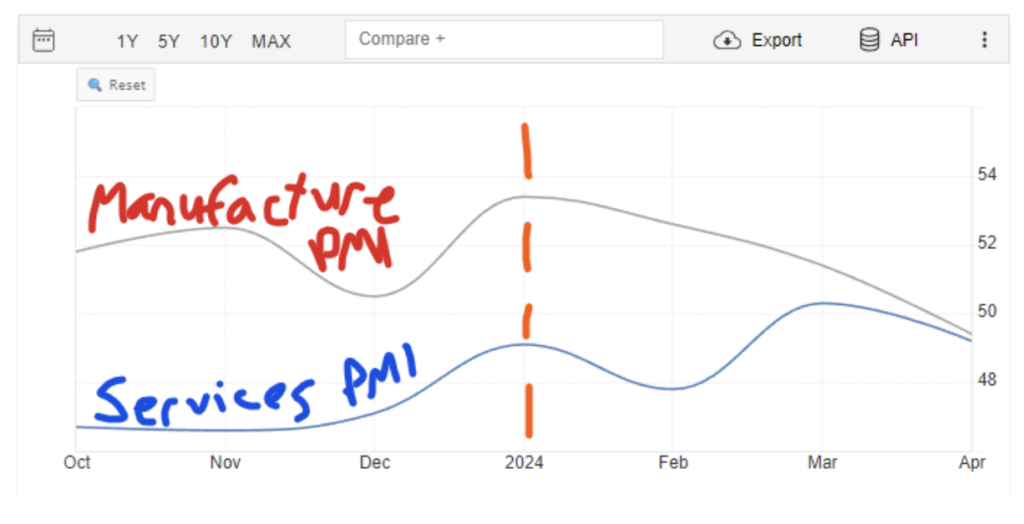

One way to determine if or when a recession is coming is to look at things like the Manufacturing and Services Purchasing Managers’ Index (PMI).

Since 2024, Manufacturing has been on a steady decline while Services are essentially breaking even. That’s good for the Fed since wage inflation, due to strong demand in the Services Industry, has played a role in inflation sticking around for longer.

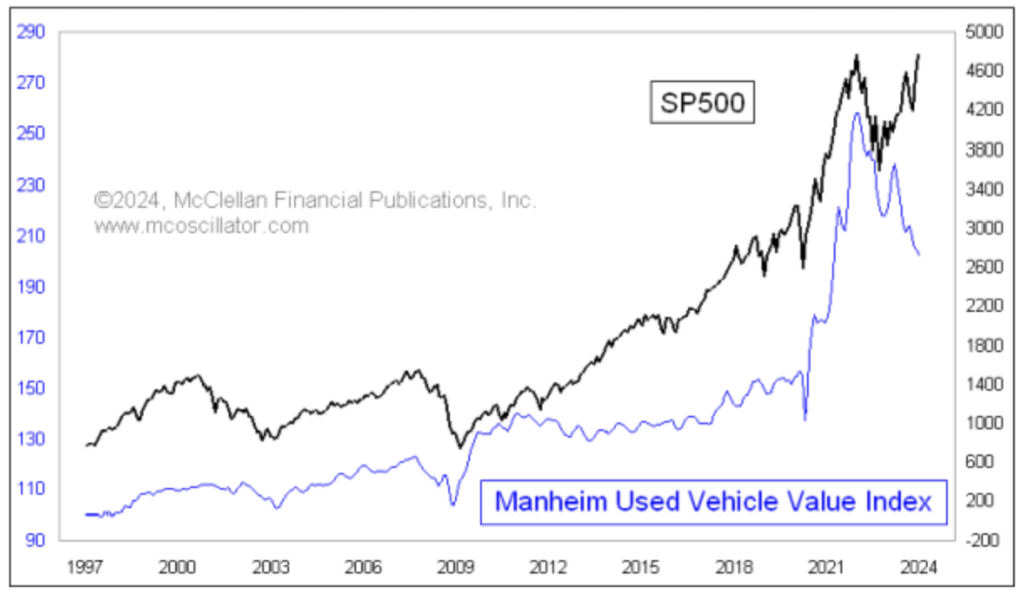

The slowdown is happening elsewhere – let’s look at the Manheim Used Vehicle Value Index compared to the S&P 500. The two have been strongly correlated until recently when the market keeps rising as used car sales and prices are declining.

I know what you’re going to write, “Used car prices are on the decline due to the pandemic highs, and now a flood of inventory is causing prices to fall – not the economy.” Maybe, but consumers also spend less when they are worried about the next round of layoffs.

Fine, let’s review how the luxury goods retailer, LVMH Group (owner of brands like Louis Vuitton, Dior, Fendi, and Tiffany & Co.) has fared recently. The stock price has been on a decline since March with luxury goods sales supposed to be relatively flat the rest of the year.

Lastly, in a week of relatively little news, we saw the Weekly Jobless Claims come in hotter-than-expected with a ticker higher in the 4-week moving average.

Fed governor Daly said that the labor market is cooling and that is what should be happening, and it’s important to note that there’s a difference between a soft labor market and one that is getting fundamentally weak.

Each of these items helps the Fed’s inflation troubles, which is also why the market has been recovering from the April pullback. A softening economy is a result of the Fed’s restrictive policies. This is what they want to happen.

So, after all that – is a recession coming? Are we already in one? Is the market headed for a 20% or more fall from here? I doubt the market will crash, but we have indicators telling us there is weakness ahead and the various Fed members have reiterated that 2% inflation is the target and they won’t change the goalpost while trying to reach it.

Investors may be rejoicing and looking forward to the eventual rate cuts, but we might have to endure the roller coaster a bit longer.

I’ve spent the week writing about the S&P 500 being overpriced compared to earnings and inflation being too high with products and services still at elevated levels.

What can you do about it? How can you prepare for what’s ahead?

Go out and have a happy Mother’s Day and spend time with the mothers in your life rather than spending money on luxury goods for them. Just don’t tell LVMH Group I said that!

Have a good weekend!

Happy Mother’s Day to all the hard-working mothers out there!