Let’s take a look at how Options Income Weekly members have fared over the past month and a half, including landing their biggest profit of the year with a position that was a bit of a divergence from our typical trade.

It’s been a while since we’ve reviewed the performance of Options Income Weekly in Filthy Rich, Dirt Poor, so there’s a good deal to cover.

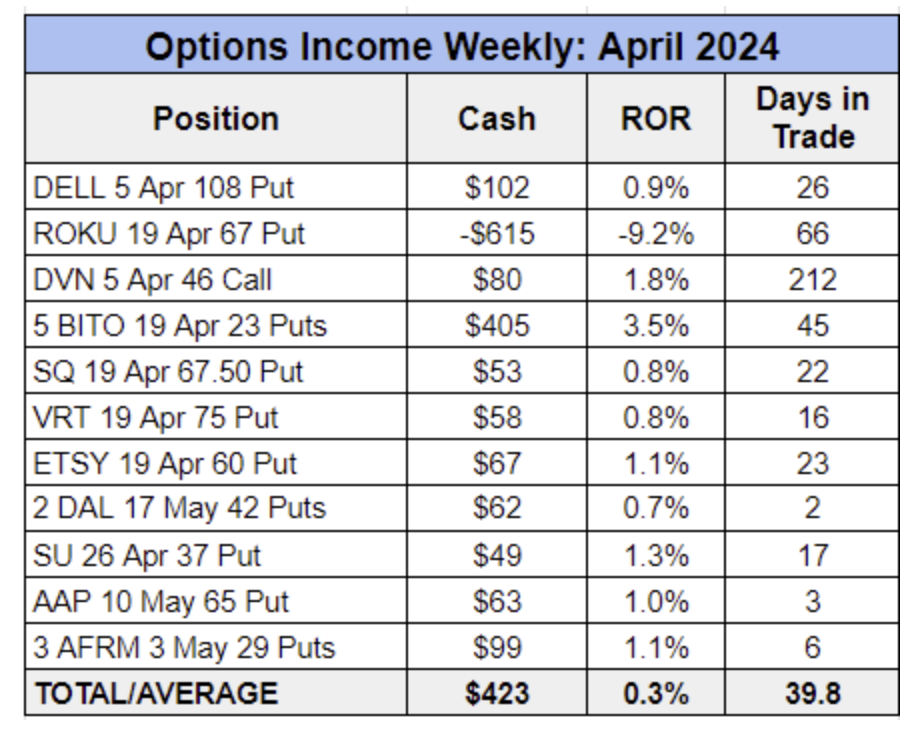

Despite the broader market’s pullback in April, with the S&P 500 down 4.2%, we closed out 10 winning positions, twice as many as we closed in March. These profitable trades combined to deliver a cumulative $1,038 in cash for members.

However, April also saw our first losing trade of the year in Options Income Weekly — in Roku (ROKU) — following an impressive 24 consecutive victories. (Read more about the lessons we learned from that trade here.)

The income generated from other positions more than offset this loss, though, resulting in a net profit of $423 for the month.

Here’s a look at all of April’s closed trades:

The winning streak hasn’t stopped in May. So far this month, we’ve closed out four profitable positions, generating $682 in income with an average return of 1.8% per trade.

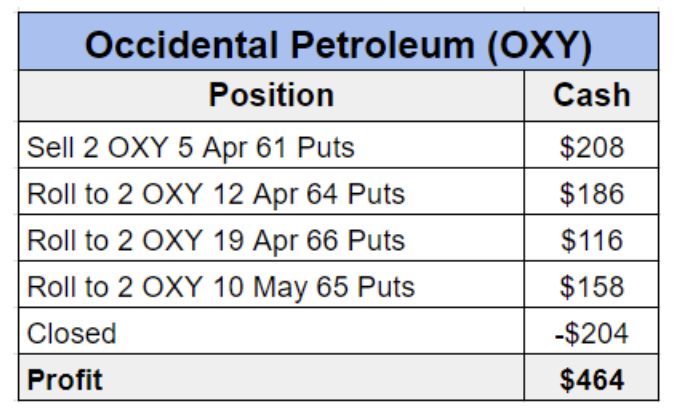

A large chunk of the income we’ve generated thus far in May comes from our position in Occidental Petroleum (OXY).

We entered the trade back in mid-March. Crude oil prices were creeping higher and energy stocks were on the rise after underperforming for all of 2023.

In particular, we thought Occidental Petroleum offered income traders an attractive opportunity. With the stock trading at $61.40, we sold two in-the-money (ITM) OXY 5 Apr 61 Puts for a large chunk of cash.

While we typically focus on short-term trades in Options Income Weekly, we noted at the time that we intended to trade OXY for a few months. In fact, we didn’t even place a good ‘til canceled (GTC) order to exit the trade. Instead, our goal was to watch the put expire worthless to keep all of the premium or to be assigned shares and sell covered calls to generate more income from the stock.

However, OXY continued to rise over the next two weeks, and we saw an opportunity to nearly double our cash in hand by rolling the position out just one week to the OXY 12 Apr 64 Put.

We rolled the position two more times over the next month, bringing our total cash in hand to $6.68.

On May 7, we recommended members close the trade. It was the day before the company was scheduled to report earnings. And while we weren’t overly concerned about the announcement moving the stock, shares had pulled back recently and were only a few cents above our 65 put strike. Therefore, we decided to take our profits off the table.

We ended the trade after holding for about two months with a profit of $464 for two contracts — the most we’ve earned from a single position so far this year — and a 3.6% return on our capital.

As it turns out, Occidental reported better-than-expected adjusted first-quarter earnings of $0.63 per share, and management forecast oil and gas production would rise 7% in the second quarter. However, profits declined in the company’s oil and chemicals businesses, while the midstream business showed a loss for the quarter.

The stock sold off more than 2% following the announcement, and shares finished the week below the $65 level. So, it appears that we made the right call by booking profits when we did, although we may get the opportunity to trade OXY again in the near future either for short-term cash or as a longer-term income generator.