The S&P 500 roared out of the gate in 2024, climbing 10.2% in the first quarter. This marks its strongest Q1 performance since 2019 and reflects a positive sentiment in the market. At Options Income Weekly, we capitalized on this bullish trend by employing a strategic options trading approach focused on generating consistent income.

We closed out five winning positions in March, bringing our Q1 total to an impressive 23 consecutive victories. This successful streak translated to over $1,900 in cash generated throughout the quarter. The average return per trade was a respectable 1.2%, demonstrating the effectiveness of our income-oriented strategy.

Here’s a look at all the trades we closed in Q1:

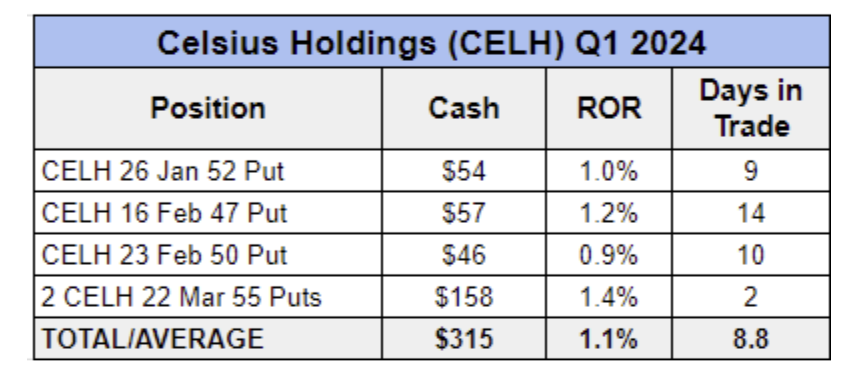

One of our standout performers was Celsius Holdings (CELH), a popular energy drink. We executed four separate trades on CELH, making it our most traded stock during the quarter. These trades contributed a total of $315 to our overall cash flow.

In addition to Celsius, we had a lot of success trading consumer discretionary stocks over the past three months, despite the sector’s underperformance relative to the broader market. These included online pet retailer Chewy (CHWY), digital sports entertainment and gambling company DraftKings (DKNG), ridesharing company Uber Technologies (UBER) and e-commerce company Wayfair (W).

While these stocks have been consistent income generators for us, our most lucrative single trade from a cash standpoint involved The Trade Desk (TTD). This trade serves as a valuable case study in navigating a volatile market and using options strategies to recover from a downturn.

We employed a buy-write strategy to manage the position and ultimately turn a profit despite a significant drop in TTD’s share price. This experience underscores the importance of staying calm and employing well-defined strategies when selling options.

Dominant Tech and Our Selective Approach

Technology stocks undeniably ruled the roost in the early stages of 2024, fueled by the “Magnificent Seven” — a group of high-performing tech giants. However, as the market rally broadened to encompass other sectors, the tech sector’s lead began to wane.

This shift has led to discussions about a new group – the “Fab Four” comprising Meta Platforms (META), Nvidia (NVDA), Microsoft (MSFT) and Amazon (AMZN). These powerhouses were responsible for nearly half of the S&P 500’s Q1 gains.

While the Fab Four are undeniably market leaders, their lofty share prices (well into the triple digits) make them unsuitable for our options trading strategy within Options Income Weekly. Selling cash-secured puts on such expensive stocks would require a significant capital commitment.

Finding Opportunities in Lower-Priced Tech Stocks

To capitalize on the tech sector’s potential while staying within our risk parameters, we set our sights on lower-priced tech stocks with high implied volatility (IV). Implied volatility reflects the market’s expectation of a stock’s price fluctuations, and higher volatility translates to potentially higher option premiums.

These stocks included chipmaker Intel (INTC), digital infrastructure provider Vertiv Holdings (VRT), software developer GitLab (GTLB) and fintech company Affirm Holdings (AFRM).

The lower price points of these stocks allowed us to generate income through option sales while keeping our capital commitment manageable. In some instances, we sold multiple contracts to boost our income generation.

Adapting to Market Shifts and Staying Ahead in Q2

The tech sector’s dominance may be fading, but we remain committed to exploring opportunities within this dynamic space. We’ll continue to monitor market conditions and identify undervalued tech stocks with promising prospects.

Our focus on the consumer discretionary sector may shift depending on the upcoming quarterly earnings reports from these companies. Chewy’s recent warning about below-average growth in the pet market, despite exceeding EPS estimates, serves as a cautionary tale. We’ll be carefully analyzing these reports to assess the health of the sector and determine whether to trade it in the second quarter.

Finally, the data suggests a positive outlook for option sellers. According to Barrons, when the S&P 500 experiences a first-quarter surge of 8% or more, as it did in 2024, the market has historically continued to advance roughly 94% of the time since 1950. This trend bodes well for our options selling strategy. However, we recognize that market corrections are inevitable, and we will adjust our strategy accordingly if stocks turn lower in Q2.