Since we just passed the halfway mark for July, let’s review how the first half has gone for Options Income Weekly members and what we are trading as we head into the back half of the month.

Our first profitable closeout of July was on underperforming chipmaker Onsemi (ON), which makes power and sensor chips for the automotive and industrial markets. Despite lagging its sector and the broader market this year, we managed to take advantage of short-term volatility in the stock, which offered an alternate — and less capital-intensive – way to play the AI mania after massive run-ups in the most well-known names.

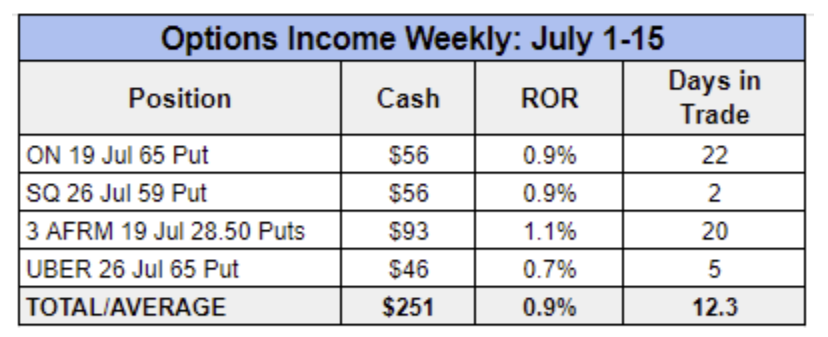

Since then, we’ve closed out three more winners in a row, generating $251 in cash in the live account so far this month and averaging a 0.9% return per trade with an average holding time of just over 12 days.

One of those trades was on Block (SQ), a fintech company that specializes in mobile payments. At one time, SQ was the most frequently traded stock in the Options Income Weekly service. We sold dozens of cash-secured puts on the stock, generating thousands of dollars in income.

Our most recent SQ trade was on for just two trading days, after a rally in the stock allowed us to book fast profits.

We entered the trade on July 10. At the time, SQ was trading at $63.12, down more than 2% on the day. A short-term pullback like this is actually ideal for entering a cash-secured put trade, and the stock had a reasonable implied volatility rank (IVR) of 54%.

This allowed us to collect an attractive credit of $0.71, or $71 per contract, for selling the 59 strike put, which was a comfortable 6.5% out of the money (OTM). Moreover, the July 26 expiration date kept us clear of the company’s Aug. 1 earnings announcement.

We set a target exit price of $0.15, placing a good ‘til canceled (GTC) order at that level. We expected to be out of that trade well ahead of expiration. But even we were a bit surprised at how fast the GTC order was triggered.

Over the next two days, SQ rallied as much as 10% and our target exit price was hit before the close on Friday, allowing us to book more than 80% of the max profit.

It was a similar story with rideshare company Uber Technologies (UBER). The stock ran up as much as 6% after we put on our trade, and we were out of the position with more than 70% of the max profit after just five days.

However, both of those bullish moves pale in comparison to the sharp move higher we got in Affirm Holdings (AFRM), which rose roughly 13% in three trading days before triggering our GTC order. The stock, which is up nearly 20% over the past week, has garnered a lot of investor interest recently.

The recent move up could be due in part to the company’s new partnership with Canadian home improvement retailer RONA, which enables eligible RONA customers to use Affirm’s buy now, pay later service for online purchases. Whatever the reason behind the bullish momentum, it quickly turned our put position, which had been in the money (ITM) just a few days prior, into another successful closeout.

These three closeouts came in quick succession, and before putting on new trades during Tuesday’s live trading session, our remaining trades all consisted of covered call positions. Three of those are recovery trades where we initially sold puts and were assigned after the underlying moved against us. We are actively selling call options to reduce our cost basis on those shares with an eye toward exiting the positions around breakeven.

The fourth call position is actually a longer-term trade on integrated energy company Suncor Energy (SU), similar to the Occidental Petroleum (OXY) trade we closed a few months back, which yielded our biggest profit in the service from a single position so far this year.

We entered the SU trade as a buy-write on May 14, purchasing 200 shares at $39.55 apiece and selling two SU 31 May 40 Calls for $0.58 each ($116 for two contracts). As you can see in the chart below, our timing wasn’t exactly ideal.

The stock topped out just after we entered the trade. Since then, shares are down about 3%, although they were down nearly 9% in mid-June before making a short-term bottom above $36. Yet, during this time, we’ve collected an additional $0.82 in call premium ($164 for two contracts) and a $0.40 per-share dividend ($80 for 200 shares). This has effectively lowered our cost basis on shares to $37.75.

Currently, we are in the SU 19 Jul 39 Call, which is set to expire on Friday. If SU moves higher this week and closes above $39 per share on Friday, we will be called out of the stock at a profit of $1.25 per share, or $250 for the 200 shares we own.

The stock is trading below that level at this time, so we may opt to roll the call again for more income as we have some time before the company reports earnings in mid-August.

In addition to our call positions, we entered two new put trades this week, going back to CRISPR Therapeutics (CRSP), a biotechnology company we’ve had success trading recently, and also putting on a trade in Citigroup (C) to capitalize on the recent strength in the financial sector.

As earnings season kicks into high gear over the next few weeks, we’ll be looking to take advantage of stock-specific volatility with new trades and the potential for some more fast closeouts before the end of the month.