At Perpetual Income, we’re focused on turning high-yielding dividend stocks into 25% to 30% annual income for your portfolio. This unique focus means that we sometimes have to say goodbye to stocks that have been solid performers because something in their story has changed.

In fact, we’re moving on from one of our top income stocks of 2023: Camping World (CWH).

To help you understand why and what makes a desirable Perpetual Income stock, let’s back up and tell you what first drew us to CWH, which we added to the portfolio back in the summer of 2022.

At the time, we noted that Camping World is really two companies. First, it’s a network of recreational vehicle (RV) dealerships and online seller of outdoor equipment and supplies for camping, hunting, fishing, skiing, snowboarding, bicycling and watersports.

Second, the company provides a portfolio of services including protection plans, property and casualty insurance programs, travel assistance, roadside assistance, vehicle financing, RV repair and maintenance services, and much more.

With a wide-ranging focus on outdoor equipment and services, Camping World was a pandemic winner. But the stock got hit along with most of the market in 2022, making it a bit of a contrarian play for us. A lot of the softness was related to rising prices at the pump, as RVs are not exactly the most fuel-efficient vehicles.

But the company was on a strong growth trajectory, with management focused on expanding its footprint by acquiring smaller RV companies and service companies.

We noted that, like a number of retail stocks, CWH is volatile and subject to consumer demand and economic conditions. But it also offered an intriguing income opportunity.

At the time, the stock was throwing off an attractive 8.3% yield. And with a cash payout ratio of around 20%, there was plenty of cash to support the dividend.

What’s more, CWH’s implied volatility had recently been in the 30% to 40% range, and there was solid open interest in the option chains, making CWH very tradeable whether selling puts or covered calls.

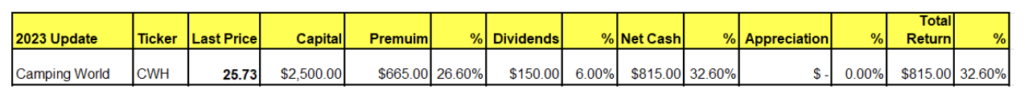

We said back in August 2022 that we expected to be able to trade CWH for six to 12 months using our Perpetual Income strategy. But we traded it for much longer than that, with CWH becoming one of our top income stocks in 2023, generating over 32% in returns.

However, during this time, part of Camping World’s story changed. In August 2023, the company announced it was cutting its dividend from $0.625 to $0.125 per share — an 80% decrease. Ouch. There had been rumors of a possible dividend cut, but we doubt anyone expected such a large one.

According to the company, the board cut the dividend to prioritize capital allocation for acquiring RV dealerships as part of its growth strategy. As we’d been saying all along, Camping World had been in serious acquisition mode.

With the dividend cut, though, CWH’s yield fell well below our 3% threshold for Perpetual Income stocks. The irony, of course, was that Camping World was such a strong performer for us.

Despite the dividend cut, the reasonable liquidity in the options allowed us to trade the stock weekly for cash through the remainder of the year. However, as 2024 got underway, there was another big change – the stock reverted from weekly options back to monthly-only option expirations.

Usually, stocks start with monthly option contracts and expand to weekly contracts as the company grows and there is demand for more frequent option expirations. It’s never clear or announced in advance why a stock with weekly options retreats to monthlies, but it’s usually determined by both the company and the exchanges based on volume, liquidity and market demand.

The switch back to monthly options combined with the dividend cut in wake of rising interest rates and a post-pandemic slowdown in RV sales hinders our ability to generate consistent income from the stock. So, we decided to move on from CWH in our Perpetual Income portfolio.

Make no mistake: We still like CWH as a long-term play.

Management has acted quickly and decisively to move from a niche player in the recreational vehicle market to dominating the space by making numerous acquisitions over the past year. The company is expanding its footprint not only in RV sales but in RV services and parts, as well as more traditional camping product lines.

Several Wall Street analysts have raised their target price on shares to around $30, which is about 20% above the current price.