We’ve been having great success trading pharmaceutical company Eli Lilly (LLY) in the Income Masters program using bull put spreads.

Pharma stocks have performed well for most of the year, and that trend is expected to continue. LLY is up nearly 60%, in part due to investor excitement about the potential of its diabetes drug Mounjaro, which is expected to be approved to treat obesity.

With a share price north of $500, selling even a single cash-secured put option on this stock would require a lot of capital. However, with bull put spreads, Income Masters members have been generating income with a fraction of the capital outlay while earning high rates of return.

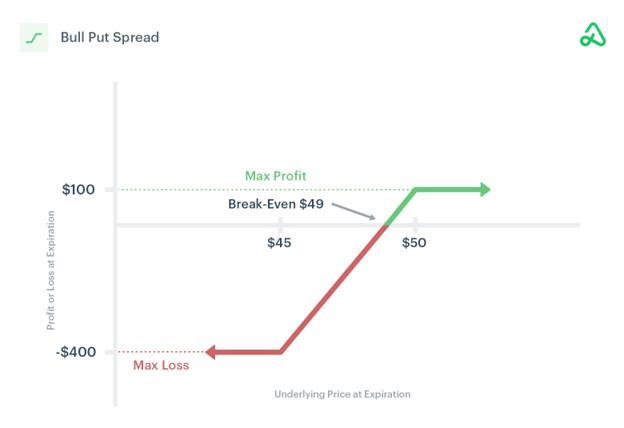

For those unfamiliar with the strategy, a bull put spread, also known as a put credit spread, involves selling a put option and purchasing a put option at a lower strike price with the same expiration date to generate a net credit.

The maximum profit is the credit received and is achieved if the top leg finishes out of the money (OTM). While the profit is capped, so too is your risk, as the most you can lose on the trade is the width of the spread minus the credit received.

Source: Option Alpha.

In addition to limiting risk, bull put spreads offer leverage, allowing you to potentially book high rates of return on the limited capital required.

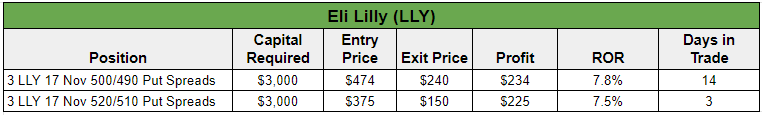

For instance, we recently closed two back-to-back spreads on LLY. For both trades, we sold three contracts apiece, raking in a good amount of cash and earning more than 7% on our capital outlay of $3,000 ($1,000 per spread). Had we sold an LLY put with a $500 strike price, we would have needed to allocate $50,000 in cash for just one contract.

We actually opened the second LLY spread just hours after closing the first. Additionally, we used good ‘til canceled (GTC) orders to exit these trades, putting our profits on autopilot.

With our most recent LLY closeout, we entered the trade on Oct. 10, opening the LLY 17 Nov 520/510 Put Spread for a net credit of $1.25 each, or $3.75 total for three spreads. We set a target exit price of $0.50 per spread ($1.50 for three contracts).

Our GTC order filled just one minute after the market opened on Oct. 13, allowing us to book fast profits and pocket $225 in cash for a 7.5% return on the $3,000 in capital we put up.

LLY is a stock we will continue to trade due to the underlying bullish trend in pharma stocks and the volatility provided by headlines and investor interest in the company’s potential blockbuster weight loss drug.

In fact, we put on another spread just last week. This one doesn’t expire until Nov. 3, and while LLY is down about 5% since we entered the position, the top leg remains comfortably out of the money.

We will roll the spread if we need to, but if the stock holds steady or moves higher, we could easily see another early closeout and add another winner to our successful LLY track record.