While rising Treasury yields and the Federal Reserve’s “higher-for-longer” mantra has put a bit of a damper on things recently, investors certainly didn’t “sell in May and go away.” The S&P 500 rose 4.8% for the month, and the Nasdaq Composite hit an all-time high above 17,000 on May 28.

It was a welcome development after April’s broader market pullback. Yet, Options Income Weekly members still managed to close out 10 winning positions in April and net $423 in cash in our live account. Our cumulative profit would have been higher, but we logged our first losing trade of the year – after 24 consecutive victories. (Read more about the lessons we learned from that trade here.)

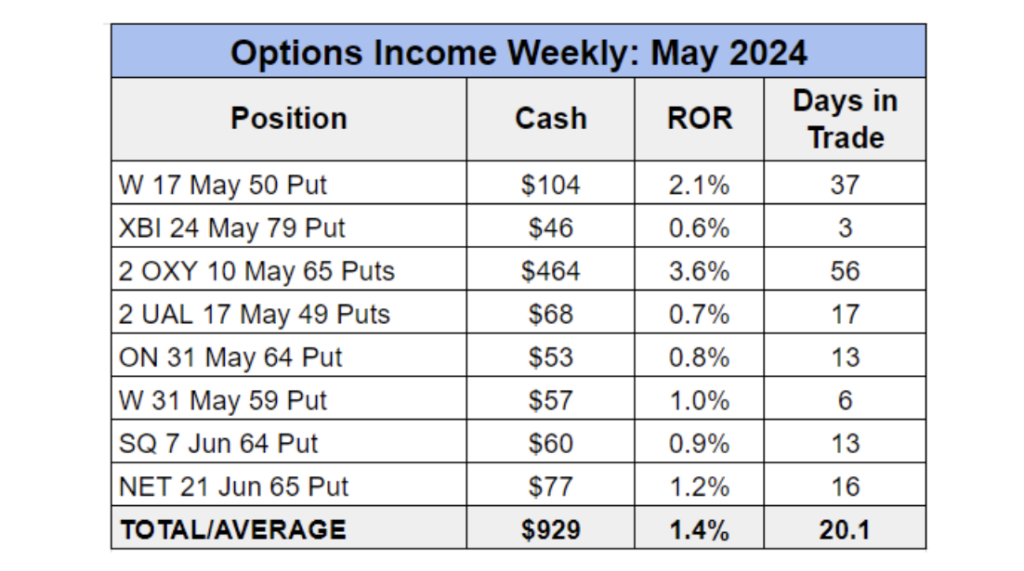

We ended up generating twice as much income in May, closing eight winners in a row and pocketing $929 in cash. This included our largest profit from a single position so far in 2024 with a longer-term trade on Occidental Petroleum (OXY). And we averaged a 1.4% return per trade in May with an average holding time of just under three weeks.

Here’s a look at all the trades we closed last month:

Technology stocks were May’s best-performing sector, due in part to strong earnings from AI darling Nvidia (NVDA). The stock gained 27% for the month, logging a new all-time high above $1,000 a share. For what it is worth, the company also announced a 10-for-1 stock split in an effort to make its shares more accessible to retail investors.

Even with the stock split, which will take effect on June 7, NVDA’s share price might be a bit high for an Options Income Weekly trade, although we regularly trade it in the Income Masters program with spreads. For Options Income Weekly, we typically trade stocks with prices well below the $100 level as a means of keeping our total capital commitment around $50,000 at any given time.

However, we did add two new tech names to the Options Income Weekly roster last month, trading onsemi (ON) and Cloudflare (NET).

Onsemi benefitted from Nvidia’s better-than-expected earnings and upbeat guidance, rallying nearly 5% on the day the company reported. It finished the month up 4%.

Interestingly, Cloudflare, which focuses on improving the security and performance of websites and other internet properties, did not participate in May’s tech sector rally. The stock lost nearly 23% last month.

NET fell sharply after the company reported first-quarter earnings at the beginning of the month, declining more than 16% in a single day. Revenue topped Wall Street’s expectations, up 30% year over year to $378.6 million. And earnings of $0.16 per share beat by $0.03. However, traders punished the stock after guidance only met expectations.

Yet, we managed to take advantage of the overblown bearish sentiment and the still-elevated volatility levels post-earnings by entering a cash-secured put trade on May 7.

With the stock trading at $74.83, we sold the NET 21 Jun 65 Put for around $1.07, or $107 per contract. The June monthly expiration was 45 days out, giving us time to manage the trade should NET continue to sell off. However, we didn’t expect to be in the trade that long, as we rarely hold positions to expiration.

We gave a target exit price of $0.30, setting a good ‘til canceled (GTC) order to buy back the put at this price.

As you can see in the chart above, NET’s price stabilized shortly after we entered the trade. The stock hit a high of $75.70 on May 23, following the release of Nvidia’s quarterly results, before pulling back. This combined with some time decay resulted in our target exit price being hit after just 16 days. We exited the trade with $77 per contract, which was more than 70% of the max profit, and a 1.2% return.

This trade goes to show you that option sellers can find opportunity even in underperforming stocks. We took advantage of an earnings overreaction and exited once we hit our profit target rather than getting greedy and trying to wring every last cent of premium out of the trade. Had we held on, the end-of-the-month sell-off in NET would have taken shares below our put’s strike price, potentially forcing us to have to roll the trade out to avoid assignment.

As we head into June, we’ll continue to be selective with our trades. Jeff Wood noted in a recent article that the first few weeks of June tend to be bearish with the S&P 500 heading lower into the week of June 17.

But as the NET trade illustrates, we don’t necessarily need a stock to trade higher to collect income from our put selling strategy. We can make money in flat or even down markets. What we do need to be successful is to put the odds in our favor by selecting appropriate expirations and strikes and exercising discipline with early exits.

Whatever the market brings in June, we’ll be ready for it.