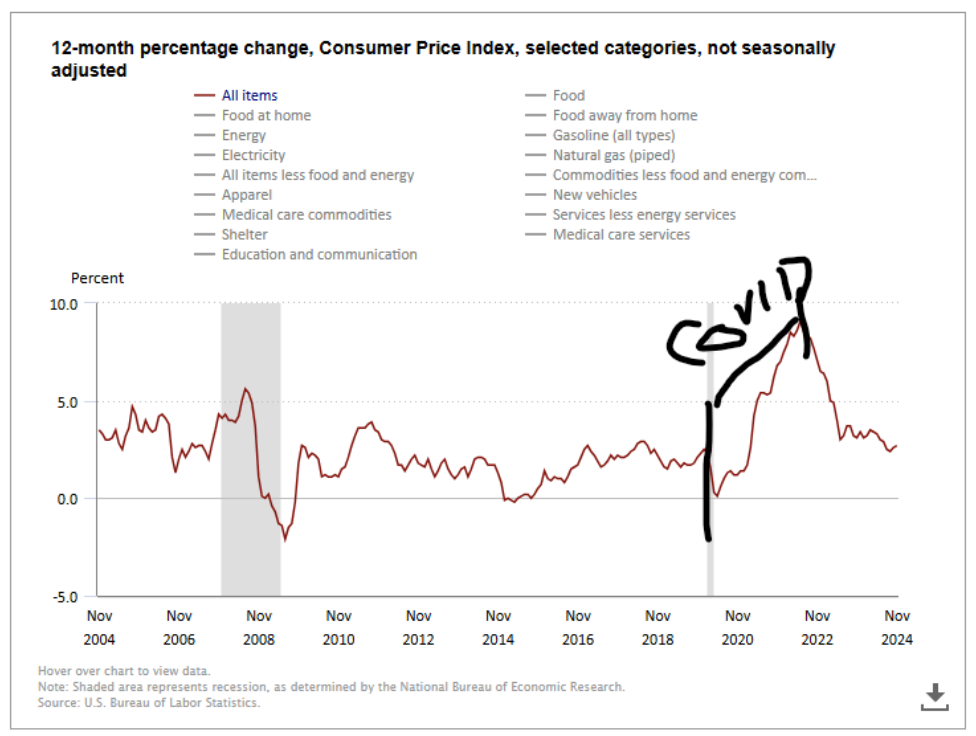

How did we get here? Let’s quickly go back to 2023. Well, maybe let’s start with 2022 when consumer prices spiked after the Covid pandemic. To combat raging inflation, the Fed raised rates and promised to lower interest rates once inflation was under control.

Ok, now back to the 2023 story…

The rally in 2023 was built on optimism. Investors hoped for the end of rate hikes, anticipated rate cuts, and a soft landing for the economy. Add excitement over AI profits and geopolitical stability, and it’s easy to see what fueled the market’s momentum.

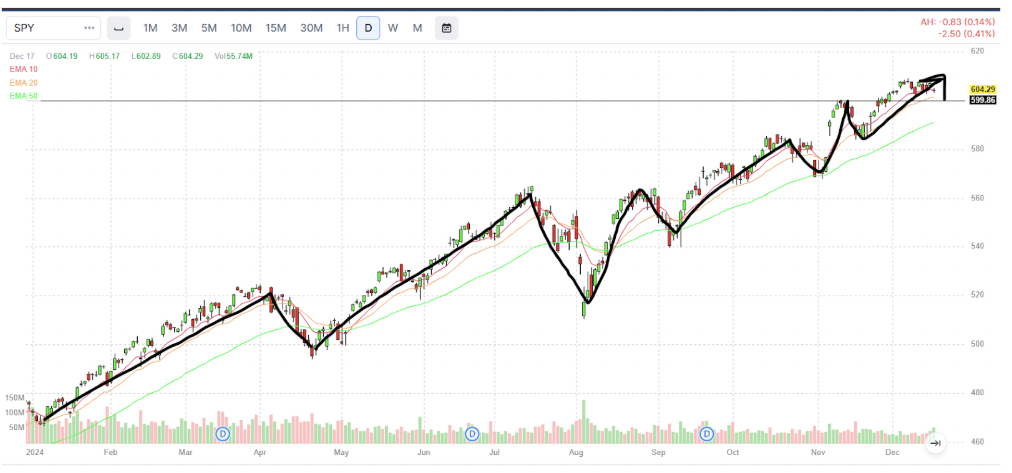

The S&P 500 increased by over 20% from beginning to end, although it certainly had two periods that made investors question their life choices.

By 2024, parts of these hopes came true: the economy slowed but avoided contraction, the Fed followed through with rate cuts, and AI excitement kept market momentum alive. Meanwhile, geopolitical crises didn’t significantly worsen, though they didn’t resolve either.

The S&P 500 started the year strong and showed quite a bit more volatility in the last six months of the year, but it’s still looking like it will be another 20% year for the index.

As 2025 begins, markets face a critical question: Can the positive events of 2024 continue? Will the soft landing hold, or will cracks in the economic foundation emerge? Will inflation continue to fall toward 2%, or could it rebound? Will pro-growth policy initiatives sustain momentum, or will they falter?

These uncertainties suggest a volatile road ahead, even if fundamentals remain broadly positive. Last week’s mixed inflation data exemplified this dynamic: headline Consumer Price Index (CPI) and Producer Price Index (PPI) figures spiked, while core metrics remained stable. The ambiguity caused volatility, a pattern we’re likely to see more often in 2025.

If you don’t believe me, take it from Fed Chairman Powell, who mentioned the word “uncertainty” four times in his December 19th speech as he spewed out a metaphor of walking through a dark room full of furniture and trying to get from one side to the other without hitting anything.

This is how the market reacted to “uncertainty.”

Inflation: A Persistent Problem

One of the central risks for 2025 is inflation—and its stubborn refusal to retreat fully to pre-pandemic levels. While headline inflation has moderated, core inflation remains sticky. This stickiness reflects structural challenges: elevated wages in a tight labor market, persistent demand for goods and services, and lingering supply chain inefficiencies.

Inflation’s path could face renewed upward pressure under a pro-growth policy framework, such as the one envisioned by the Trump administration. Tax cuts, deregulation, and infrastructure spending could ignite economic activity, but they also risk overheating an economy already grappling with inflationary pressures. The combination of higher demand and constrained supply could lead to stagflation—a toxic mix of slow growth and high inflation.

The Federal Reserve’s rate cuts in 2024 aimed to support growth but risked undermining the inflation fight. The Fed and a pro-growth presidential administration will need to figure out who will be leading on the dance floor.

Navigating the Risks of 2025

Despite these challenges, the market’s underlying fundamentals remain positive. Economic growth has been steady, the Fed’s easing cycle is ongoing, and policy initiatives could further support expansion. However, the elevated expectations built into current market valuations mean any disappointment could trigger sharp reactions. This has been something John has mentioned several times as the multiple of the S&P reaches astronomical highs.

It’s critical to stay nimble, as the interplay between growth, inflation, and policy will likely dominate market dynamics in the year ahead.