Mega-cap tech stocks continue to dominate the market, but beneath their success lies a growing unease among investors about the Federal Reserve’s interest rate policies. While these tech giants boast substantial cash reserves and can withstand a “higher for longer” strategy, the average S&P 500 stock is more vulnerable than ever to rising yields. Although the S&P 500 is up for the year, not all companies are sharing in the glory.

The average S&P 500 stock shows unprecedented sensitivity to bond yield changes. Rising yields harm these stocks while falling yields help them. However, the S&P 500 index itself appears less affected by these fluctuations. This disparity arises because Big Tech companies, which hold a significant weight in the index, are largely insulated from the Fed’s maneuvers due to their vast cash reserves.

A problem is with earnings.

The median stock in the S&P 500 is valued at 18 times forward earnings, whereas mega-cap tech companies trade at over 21 times forward earnings. The large tech companies can maintain these levels, whereas the rest of the index cannot. Yet, we still evaluate the entire market based on the S&P 500 index.

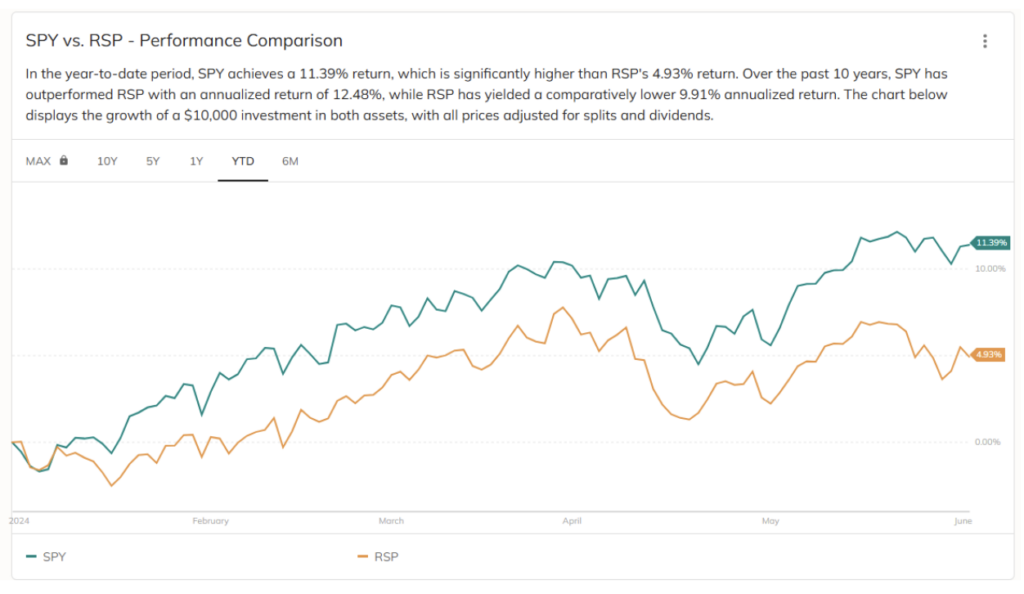

To better understand interest rate impacts, compare the traditional S&P 500 (SPY), which gives more weight to larger companies, with its equal-weighted counterpart (RSP), which treats smaller firms equally. The standard S&P 500 has risen by over 10% this year, while the equal-weighted version has increased by less than 5%.

Investors wary of prolonged high interest rates have avoided smaller S&P stocks and loaded up on mega-cap AI names, like Microsoft, Nvidia, Alphabet, Amazon, Meta, and more.

If the Fed delays rate cuts, as recent policy makers suggest, it will place further strain on segments of the economy already struggling with high rates. Big Tech sales are likely to remain stable unless the economic downturn becomes severe, unlike sectors such as retail, finance, and manufacturing.

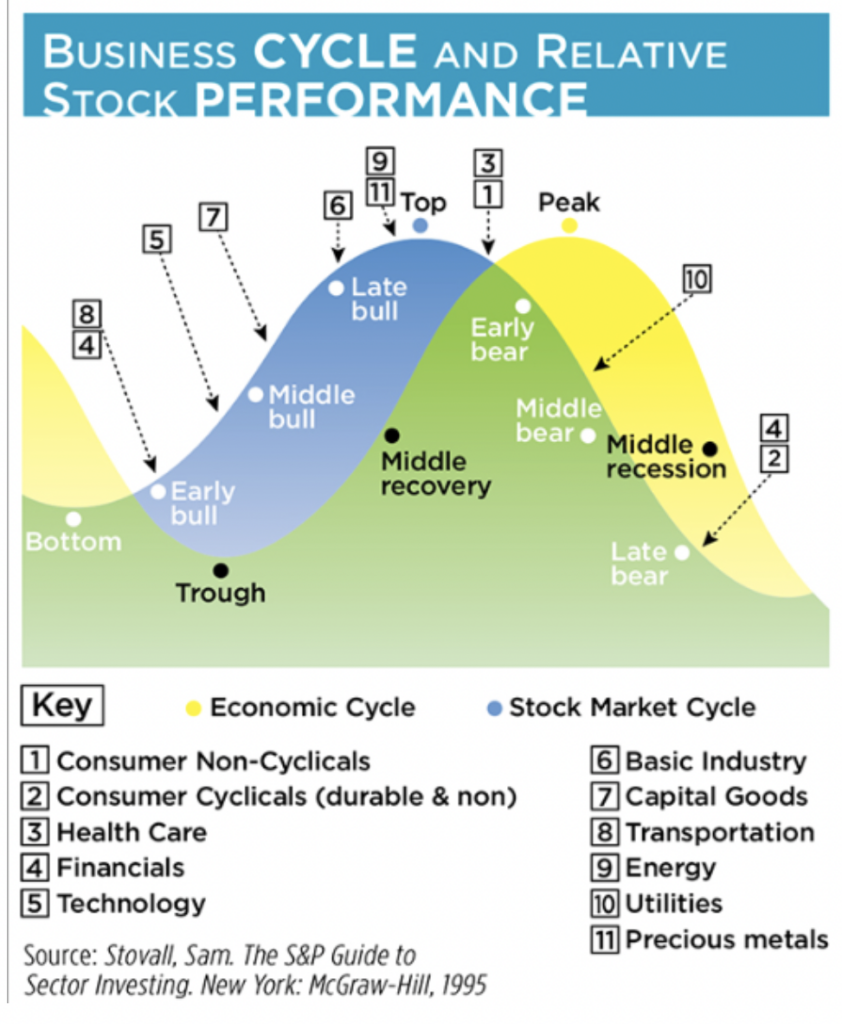

However, depending on where you feel we are in the Stock Market vs. Economic cycle, as shown in the next chart, tech stocks [5] tend to perform best in the middle bull stock cycle. Let’s assume we are in a middle bull phase. We should be looking ahead to see what industries are likely to outperform the market.

Capital Goods, Basic Industry, Energy, and Utilities tend to be more value-based than growth-based.

In other words, during a middle economic cycle recovery, history favors value stocks over growth stocks. The mega-caps may have shown the market what AI can do but now is the time for the rest of the market to participate in the rally after implementing changes driven by AI initiatives.

While rate cuts would undoubtedly help most companies, I think rate cuts can’t come soon enough for the non-mega-caps in the S&P 500. If that is the case, we should see a rally in value over growth as the stock market cycle peaks and the economic cycle navigates through a middle recovery period.