The major indexes closed the first half of 2024 on Friday with strong gains. The Nasdaq Composite led the pack with an 18% year-to-date advance, driven by investor interest in AI, while the S&P 500 rose nearly 15% and the Dow was up around 4%.

In general, a strong first half of the year leads to above-average full-year returns. But with a presidential election on the horizon and an interest-rate cut far from a certainty in 2024, the market has a few hurdles left to clear.

The case for a fall rate cut was strengthened by Friday’s core personal consumption expenditures price index reading. Core PCE, which is the Federal Reserve’s preferred inflation gauge, rose by just 2.6% in May compared with a year earlier and 0.2% compared with April. This was in line with expectations and marked the lowest annual rate since March 2021.

But we’ve watched all year as traders have scaled back their rate-cut expectations – from at least six at the start of 2024 to just two currently. It’s possible we could see those expectations continue to shift – down to one or even none. Despite some progress, inflation remains sticky. And while there certainly is no consensus among Fed officials on the near-term future of monetary policy, the loudest refrain seems to be “higher for longer.”

Yet, the lack of rate cuts has not held the market back, with both the S&P 500 and Nasdaq hitting new all-time intraday highs on the final trading day of June.

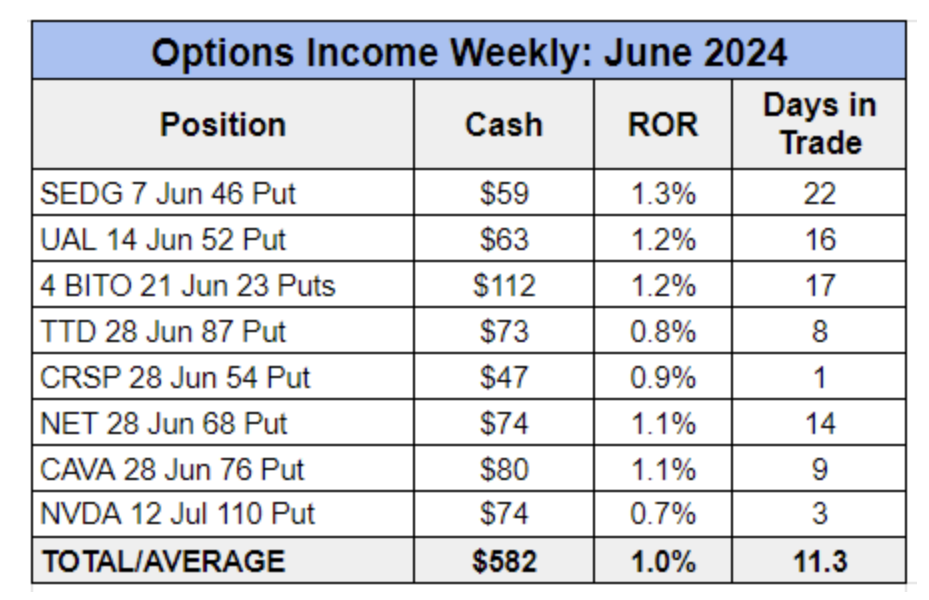

At Options Income Weekly, we closed out June with eight profitable trades on the books. We netted $582 in cash in our live account, averaging a 1% return with an average holding time of just over 11 days.

Here’s a look at all of the trades we closed in June:

June’s winners included a one-day trade on CRISPR Therapeutics (CRSP), which develops gene-based medicines. This newcomer to the Options Income Weekly universe was brought to our attention by members as a potential income play.

We also got the opportunity to trade Nvidia (NVDA) for the first time in this service following the artificial intelligence leader’s 10-for-1 stock split on June7. Prior to that, the company’s triple- and even quadruple-digit share price made it unsuitable for Options Income Weekly, where we typically trade stocks with sub-$100 share prices as a way of managing capital allocation.

In general, we try to keep the maximum capital allocated to Options Income Weekly positions to around $50,000, which makes this program perfect for those who are newer to trading options for income and/or those with smaller portfolio sizes. Of course, we also have members with bigger portfolios who may scale up by trading additional contracts to generate more income, as well as those who allocate a portion of their larger portfolios to trading this strategy.

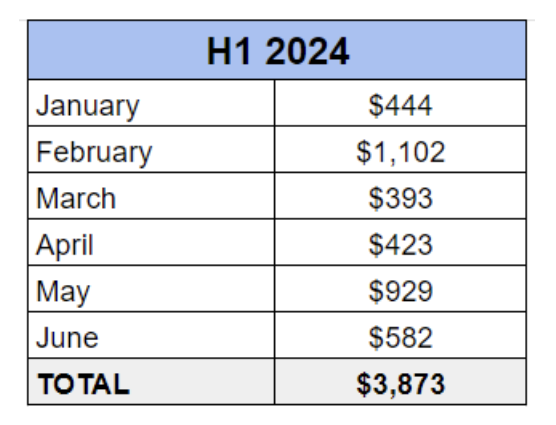

When combining June’s results with May’s $929 in income and April’s $423 despite the broader market pullback, our Q2 total was $1,934 in cash generated from selling puts and covered calls.

And here’s a look at our results for the first half of the year:

We’ve racked up a total of $3,873 in cash in the live account. We’ve closed 50 trades in 2024, 49 winners and one loser (which taught us a valuable lesson) for a 98% win rate.

As we’ve been saying, our hunt for premium has been complicated by the low-volatility environment, with the CBOE Volatility Index (VIX) hovering near multiyear lows. In the chart below, you can see the decline in the VIX over the past two years.

The lack of volatility is the result of a market that has powered higher despite economic uncertainty and a lack of interest-rate cuts. Per CNBC and FactSet, the S&P 500 index is in its longest stretch without a 2%-plus sell-off since the financial crisis.

On the one hand, a bullish tailwind is helpful. On the other hand, the lack of fear has translated into a lack of option premium, forcing us to adjust our income-generation strategy by looking for income in new places, going closer to the money and going further out with our expirations (although this does not necessarily mean we are staying in positions longer).

It’s possible we could see a pickup in volatility as we head into the third-quarter earnings season, which kicks off mid-month with the major banks reporting. This would be a welcome development. But even if the VIX remains low, we should see opportunities to capitalize on volatility in individual stocks with some earnings trades.

Overall, our Options Income Weekly results from the first half of the year, including our 98% win rate, show that we’ve been able to generate consistent income without needing to take on too much additional risk. And even when positions go against us – as a few have recently – we’ve been able to use recovery strategies to get back to breakeven or profitability in most cases.

We’ll be looking to continue our win streak in the second half of 2024 and beyond.