August 21st, 2023

What To Do If The Market Falls?

This recent pullback has everyone on edge, especially as stories come out of someone making a $1.6 billion bet that the stock market will still crash by the end of the year. While the Fed is in Jackson Hole, Wyoming this week, the economic reports have been scarce, so that allows us to discuss what will stabilize the markets this week and revisit some hedging strategies.

The market continued lower last week as moderate economic data resulted in treasury yields steadily moving higher. While nothing bad happened in the U.S. over the last 2-3 weeks, the S&P 500 continues to drop.

And while no one likes going through a 5 – 10% drop, these happen about 3 times a year, so the first thing to note is that it’s normal market movement. Next is that the market got ahead of itself with better-than-expected economic data and artificial intelligence mania fueling the rise higher for much of 2023. Now as economic news is stabilizing (we’re seeing signs of inflation again rather than deflation), the market is running out of bullish catalysts to keep with its gains.

We’ve been writing about the high valuations in the S&P 500 and stock prices being historically high compared to future earnings estimates and now we’re seeing the market come back down to Earth and reset.

The key to getting this market to calm down will be for Treasury Yields to go back to being boring and stop moving higher each week. The August flash PMI reports on Wednesday and Fed Chairman Powell’s speech on Friday are the two keys for the week.

A stronger-than-expected flash PMI will push yields higher, which will keep pressure on equity stocks (they will keep falling). A weak PMI will lower yields, which could help lift the equities market.

Lastly, if Powell pulls out another hawkish speech like last year, treasury yields will keep higher for longer, and that will keep equities going lower.

How can you hedge against these negative events?

Back on July 25th, John Hutchinson wrote about two ETFs you could use.

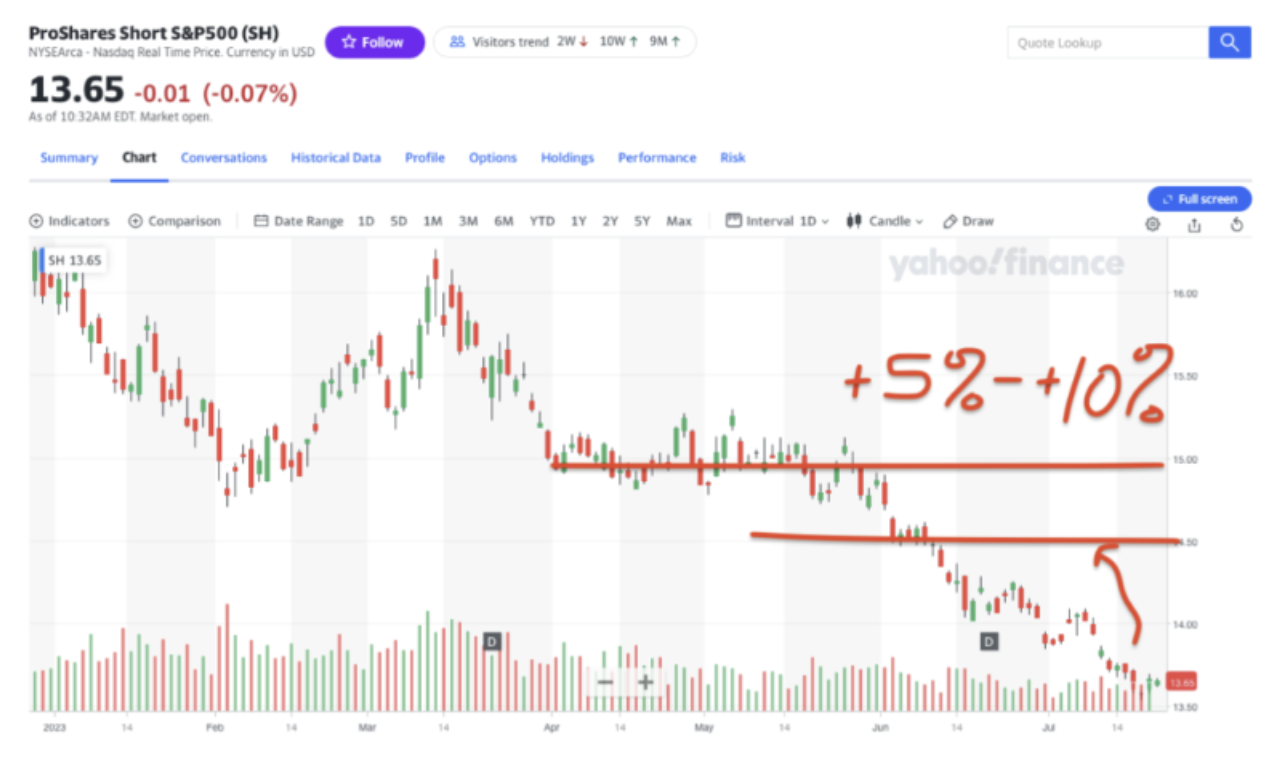

First, he wrote about the ProShares Short S&P 500 (SH). “Looking at the current chart, a correction in the S&P 500 should move the SH to $14-15 price levels, which would represent a 5% to 9.8% profit potential from current prices.”

And here’s where it is at the end of last week:

He called it, as it closed the week at $14.24. That’s a 4.4% gain as the S&P 500 cratered last week.

His other pick was the 2x inverse ETF, ProShares UltraShort S&P500 (SDS). “A move from current prices (33.13) to future resistance would provide a potential 13.2% return.”

That was then and this is now – a move up to $35.62, or about an 8% gain.

As he mentioned, the options for the ETFs are thinly traded, but the ETF prices are low enough that you can buy shares and still hedge your portfolio against further movements lower.

Later this week we will revisit another one of John’s techniques to hedge your portfolio using a put options ladder.

If you have any questions, comments, or anything we can help with, reach us at any time.

Email: [email protected]

Phone: (866) 257-3008

Jeff Wood

Editor, Filthy Rich Dirt Poor

Coach, Options Testing Lab

Any trade or trade idea discussed is for educational purposes only. They will not be tracked as an official trade recommendation.